Image Source:

Image Source:

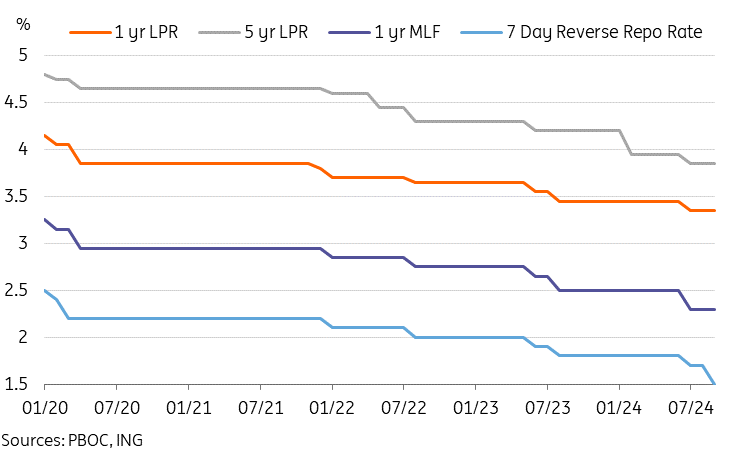

The PBOC continued to ease policy in a bid to support growth

With a slew of weak economic data in the last few months, we have already noted that without aggressive policy support. After last week’s 50bp rate cut from the Fed and subsequent CNY strengthening, we also argued that the PBOC no longer had its hands bound to maintain currency stability and now had a window for monetary policy easing.Rather than spacing out multiple small easing measures, the PBOC announced a multitude of measures today. The most important move was a 20bp cut to the benchmark 7-day reverse repo rate, bringing the new rate to 1.5% from 1.7%. Given previous patterns, markets had been leaning toward expecting multiple 10bp rate cuts, so a 20bp cut represents a slightly stronger than expected move. However, the net impact will depend on whether we see further cuts ahead or whether the PBOC falls into a wait-and-see mindset after today’s policy package.The second more well-signalled move was a 50bp cut to the required reserve ratio (RRR), bringing the RRR for major banks down to 9.5% from 10.0%. This move in our view is mostly to help buoy sentiment, as the current issue is not banks lacking the funds to lend, but rather a lack of high-quality borrowing demand amid downbeat sentiment. As we saw with the February RRR cut, this is unlikely to have a major impact on credit activity by itself, but in conjunction with the rate cut could help support credit activity. Additionally, funds and brokers will now be able to access PBOC funding in order to buy stocks. It is uncertain at this point how this will shape out, and whether or not these rates are more competitive compared to market rates, but it is another signal of support for risk assets. Overall, we feel today’s measures are a step in the right direction, especially as multiple measures have been announced together rather than spacing out individual piecemeal measures to a more limited effect. We continue to believe that there is still room for further easing in the months ahead as most global central banks are now on a rate-cut trajectory. If we see a large fiscal policy push as well, momentum could recover heading into the fourth quarter. PBOC cut benchmark 7-day reverse repo rate by 20bp

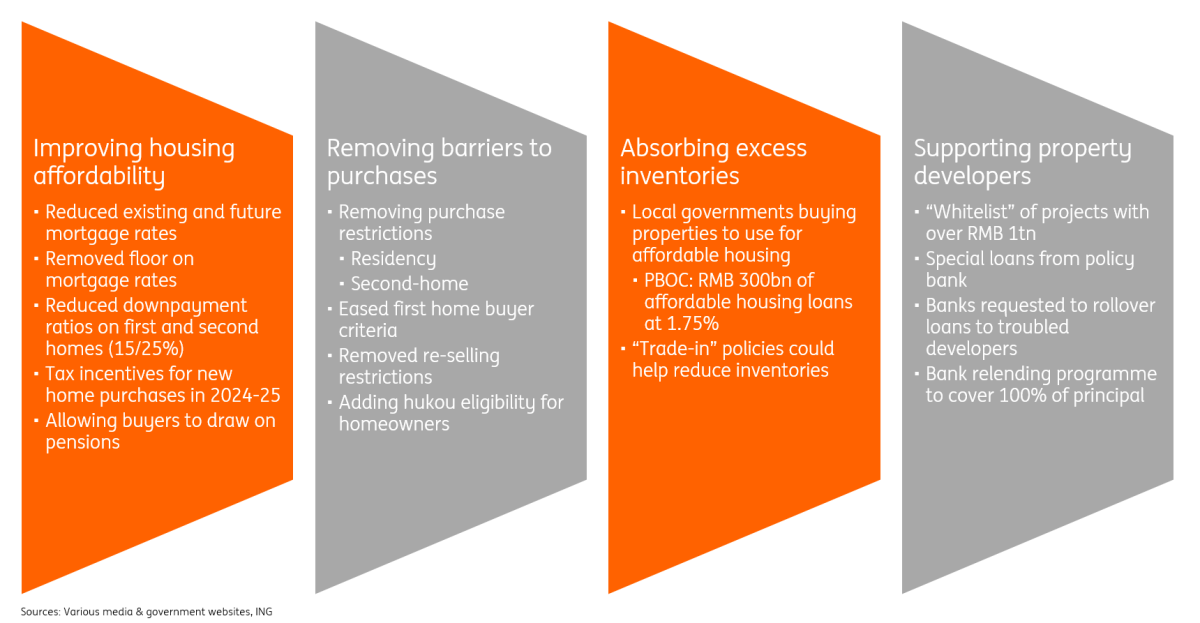

Property market support continues to roll out

After last month’s , it was clear that we would need to see more support measures rolled out to arrest the downturn of property prices. The PBOC signalled some support in this direction ahead.Governor Pan confirmed that existing mortgage rates will be cut, a measure which has been well-signalled in recent weeks. The cut to existing mortgages will offer some relief to households, and could offer some support for consumption in the coming months, though given the current propensity to save, this effect certainly will not come through on a 1:1 basis.The downpayment ratio on second home purchases will also be reduced to 15%, down from 25% previously. This reduction follows a similar move for first home purchases earlier in the year. In conjunction with lower mortgage rates, this could support buying activity on the margin. However, given downbeat sentiment, we expect this to have a limited impact as households are unlikely to be swayed by the prospect of taking on a larger mortgage to acquire a second property when the overall price momentum is still trending downward. Furthermore, the PBOC will also ramp up its re-lending programme to banks, providing 100% of the principal of bank loans for SOEs to acquire unsold property inventories. This is a move which should ease the reticent of some banks to provide property-related loans and should help to accelerate property acquisition. It will be worth closely monitoring how housing inventories develop in the coming months, and how proactive SOEs are in this process. We have seen plenty of property support measures this year, but they have thus far been insufficient to establish a trough. The PBOC’s new measures will help but we will likely need to see additional city level measures ramped up as well.For a recovery of the property market, two things need to happen. First, we need to see prices stabilise if not recover. Second, we need to see excess housing inventories come down toward historical norms. Until then, the drag on growth will continue.

China has unleashed a slew of property support measures so far this year

Market impact

Today’s policy package announcement has had relatively clear implications for markets. Equities rallied in the aftermath of the press conference, with the Hang Seng Index outpacing the CSI 300, likely benefiting from the announcement of funding for stock purchases. The CNY had been in the middle of the pack for Asian currencies in terms of performance since the FOMC meeting, but the PBOC easing will likely lead to a little more weakness in the CNY, with the USDCNY moving up in response to today’s announcements. Short-term risks remain slightly balanced toward the depreciation side, with external factors including developments on the Fed’s easing trajectory as well as any potential shifts in the US election momentum. And on the domestic side, we are still seeing weak growth momentum and leaning towards an easing bias. In the medium term, interest rate spreads should still favour a gradual CNY appreciation trend. We expect the CNY will remain a low volatility currency in the Asian region given the PBOC’s resistance to large moves in either direction. Our year-end USDCNY forecast remains unchanged at 7.10. 10 year CGB yields have been trending toward the 2% level at the time of writing, and downward pressure on yields will likely remain, as risk appetite remains limited domestically, driving funds toward safe sources of yield. Despite the recent PBOC intervention, market forces may move yields below 2% at some point. In our view, rather than commiting too many resources toward intervening on the secondary market, policymakers could consider taking advantage of low interest rates to increase bond issuance and use the proceeds for providing fiscal policy support to support the economy. More By This Author:Asia Morning Bites For Tuesday, Sept 24Rates Spark: The 2Y10Y Bund Disinversion Is StructuralThe Early Cutting Cycle – What The U.S. 10yr Should Do

The PBOC Has Unveiled A Monetary Policy Easing Package In A Bid To Support Growth