Image Source: With macro risks tilted to the downside there is room for pricing a scenario requiring a faster central bank response. Whether that justifies low long-end yield levels is a different question. We see more curve steepening pressure from both ends. French spreads widened again, but it was no widespread risk-off this time.

Image Source: With macro risks tilted to the downside there is room for pricing a scenario requiring a faster central bank response. Whether that justifies low long-end yield levels is a different question. We see more curve steepening pressure from both ends. French spreads widened again, but it was no widespread risk-off this time.

The early cutting cycle – what the US 10yr should do

We sent out a report on directions for the US 10yr. It’s . For 2024, it’s 3.9% next for the 10yr yield, then a think about 4%. Which ultimately fails, and we revert back down towards 3.5%. A dip below that makes little fair value sense if the forward view for the Fed is they don’t break below c.3%. Subtract c.50bp from each of these to get what it means for 10yr SOFR.

Only inflation surprises can stop a steeper Bund curve

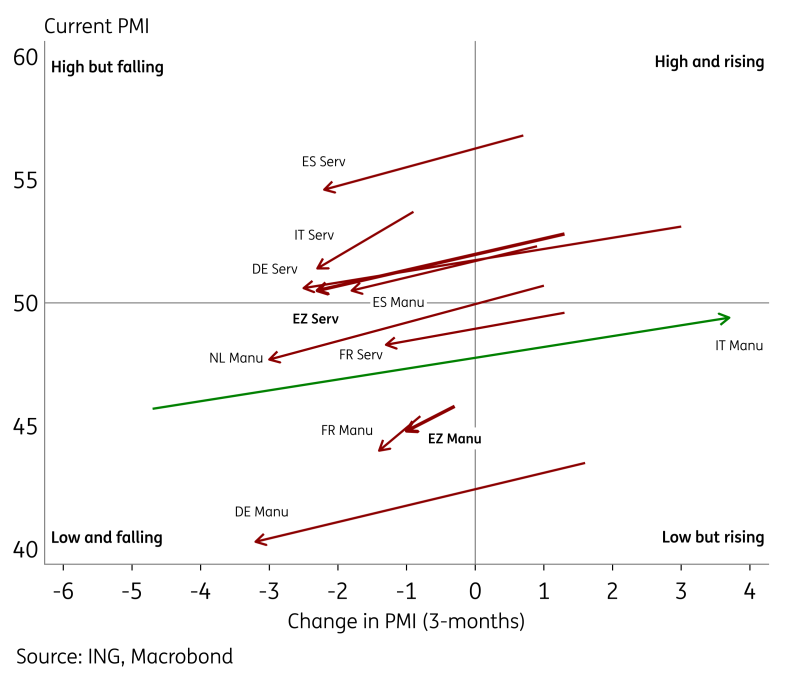

Eurozone PMIs disappointed, again, but seeing that equities were still up on the day, the numbers clearly didn’t shake markets. These dynamics of disappointing economic data combined with risk assets performing well is typical of the current environment; markets seem content with a cyclical slowdown – if this means more incoming European Central Bank cuts. Recession risks continue to be priced in but is not the base case, and whilst PMIs are slowing, the services components continue mostly in expansionary territory.Against this backdrop the 2Y10Y Bund curve disinverted for the first time since 2022, a symbolic milestone, that was preceded by the UST curve earlier this month. With eurozone growth clearly slowing down, and the Fed kicking-off with a big 50bp cut, markets seem excited to price in faster and more ECB cuts. But we warrant the risk of markets getting ahead of themselves. Lower oil prices may ease inflation pressures, but the ECB still has wage growth concerns, which could linger while the job market remains tight.Having said that, we still believe the direction is steeper for the Bund curve and the disinversion should remain in place. We too think a soft landing is the most likely outcome and thus as long as the data doesn’t turn into a terrible direction, the back end of the EUR curve should see some retracement higher. If, on the other hand, we get more severe downside surprises, or even worse, something breaking, then the front end would still have plenty of room to fall. Either way, we think the 2Y10Y will continue steeper.

Almost all eurozone PMIs down in the past 3 months

French bond spreads widen to levels last reached around the election

Prime Minister Barnier presented his government over the weekend and given the criticisms he faces some will doubt the durability of this government. The next task is a budget to bring French finances back into line with EU rules. Barnier has sought an extension to deliver his budget until the end of October. That all is not that much of a surprise, though. The deteriorating macro backdrop as reflected in the disappointing PMIs might present itself more as an additional challenge.That said the widening this time around looks different in the sense that other risk measures are on much more benign levels. Bund ASWs widened somewhat on Monday, but at 25bp we are well in recent ranges and nowhere near the 35bp area witnessed in prior French-related risk-off episodes.Still, wider French spreads can have implications for markets such as SSAs, in particular when we look to SSA issuers such as the EU, traditionally trading more closely linked to France. While the other two European Supras EFSF and ESM (after Monday’s transaction) have completed their funding for the year, EU still has €33bn ahead of it after the latest auctions, implying a steady and prominent presence in the primary market that can set the broader tone.

Tuesday’s events and market view

The main data point to watch in the US is the Conference Board’s consumer confidence index. The consensus is actually looking for a further slight improvement. The only scheduled Fed speaker for the day is Governor Bowman. The eurozone sees no notable releases apart from Germany’s Ifo business climate index, which could hold further softening in store. ECB speakers for the day are Muller, Escriva and Nagel.Primary markets will see Germany selling 2-year bonds (€4.5bn), the UK selling 9-year Gilt inflation linked bonds (£3.75bn) and the US selling new 2-year notes (US$69bn).More By This Author:The Early Cutting Cycle – What The U.S. 10yr Should Do Eurozone Business Activity Is Now Contracting, According To PMIsThe Commodities Feed: Speculative Interest In Precious Metals Continues

Rates Spark: The 2Y10Y Bund Disinversion Is Structural