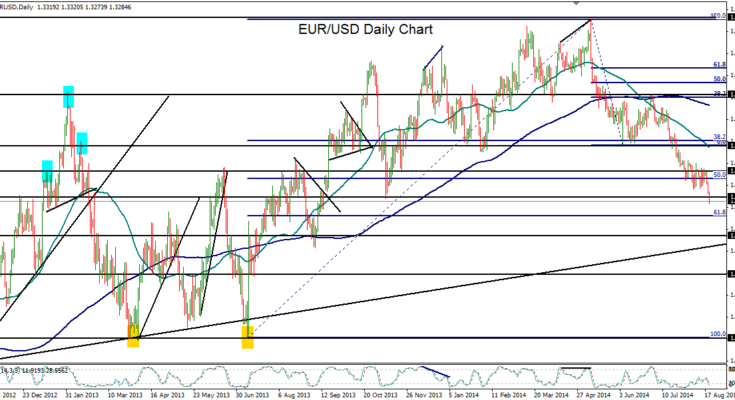

August 20, 2014 – EUR/USD (daily chart) on Wednesday has tentatively broken down below its original downside target of 1.3300, establishing a new 11-month low and extending the sharp bearish trend that originated from the May multi-year high.

The downtrend from May’s 1.3993 high has been swift, declining by more than 5% in around three months. The only respite during this newly established bearish trend thus far was a 38% pullback up to 1.3700 resistance during the month of June.

During that same month, the 50-day moving average crossed sharply below the 200-day moving average, a technical event that had not occurred since April of 2013, which highlighted the strength of the new bearish momentum.

After the breakdown below key 1.3500 support last month in late July, the stage was set for an extension of the downtrend towards the 1.3300 support target, last hit in November of 2013.

Now that this pivotal target has been reached and broken, a continuation of the entrenched bearish trend has been confirmed with a new downside target around the 1.3100 level, which was last hit in September of 2013. Upside resistance on any rebound/pullback resides around the 1.3400 level.

James Chen, CMT

Chief Technical Strategist

City Index Group

Forex trading involves a substantial risk of loss and is not suitable for all investors. This information is being provided only for general market commentary and does not constitute investment trading advice. These materials are not intended as an offer or solicitation with respect to the purchase or sale of any financial instrument and should not be used as the basis for any investment decision.