(Click on image to enlarge)

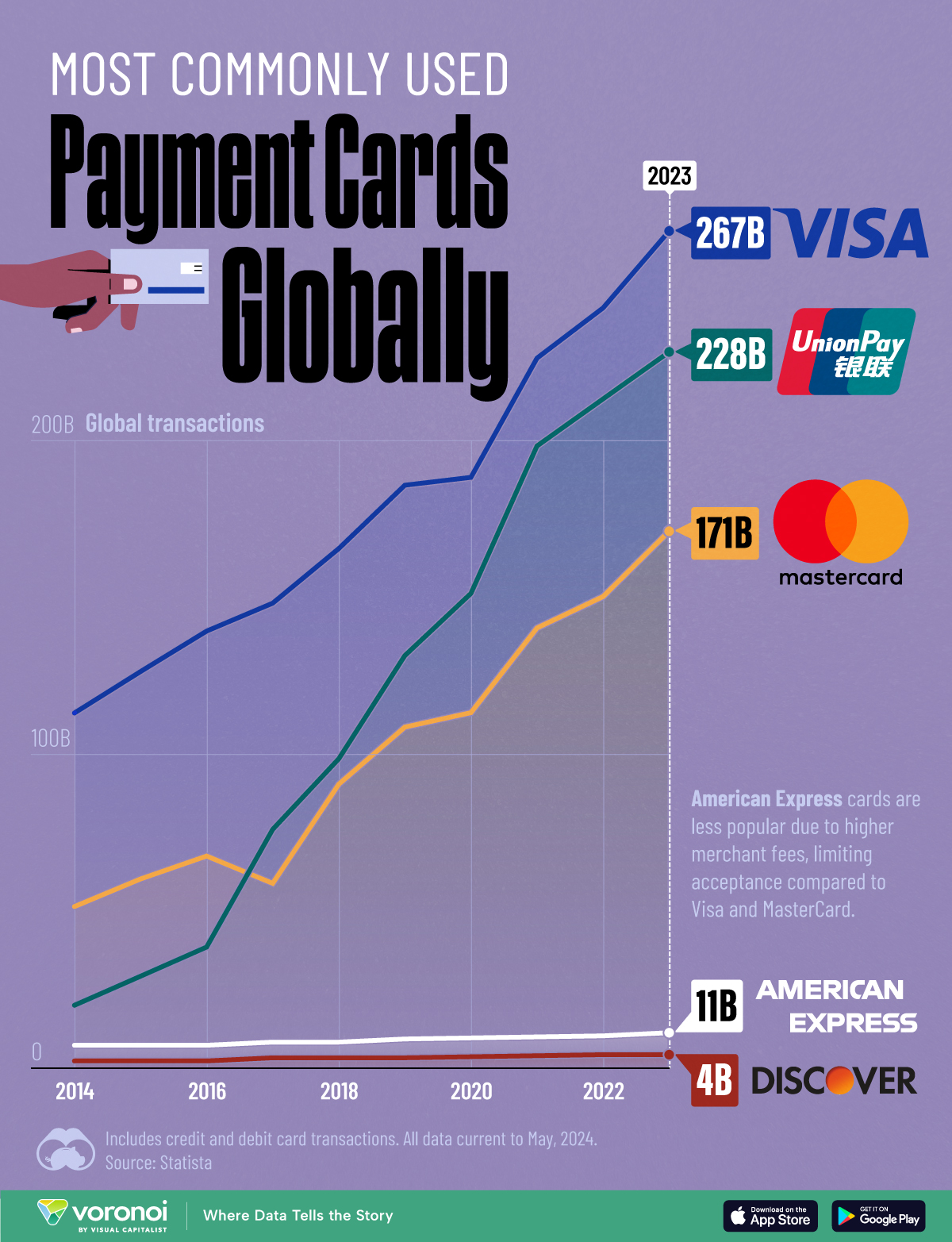

This graphic shows the number of global transactions for five major payment card companies (Visa, Mastercard, UnionPay, American Express, and Discover) from 2014–2023.Data for the visualization includes both credit and debit card transactions and is sourced from , current up to May 2024.

UnionPay Now #2 in Global Card Transactions

Card services tend to be imagined as between Visa and Mastercard. However, founded in 2002, China’s UnionPay surpassed Mastercard by transaction volume in 2017.In 2023 UnionPay recorded 228 billion transactions globally, now firmly in second place behind Visa (267 billion). According to , it also surpassed both Visa and Mastercard in terms of overall payment value as well. Note: Figures rounded.UnionPay’s largest market is China, where it’s the only , linking all the ATMs. It’s also worth noting that the majority of UnionPay transactions are debit transactions, though its credit card products are growing fast.Meanwhile, promising fintech competitors like PayPal and Apple Pay have now turned into Visa and Mastercard collaborators in a bid to secure a spot in the massive and lucrative industry.Part of the reason is how broad-reaching Visa and Mastercard infrastructure is. As this article explains, the two card giants have essentially built the highways of the payment world and now collect a toll every time there’s a transaction.And even the amount of toll can make a difference in market share. For example, American Express cards are less popular due to higher merchant fees, limiting their acceptance.More By This Author:

Note: Figures rounded.UnionPay’s largest market is China, where it’s the only , linking all the ATMs. It’s also worth noting that the majority of UnionPay transactions are debit transactions, though its credit card products are growing fast.Meanwhile, promising fintech competitors like PayPal and Apple Pay have now turned into Visa and Mastercard collaborators in a bid to secure a spot in the massive and lucrative industry.Part of the reason is how broad-reaching Visa and Mastercard infrastructure is. As this article explains, the two card giants have essentially built the highways of the payment world and now collect a toll every time there’s a transaction.And even the amount of toll can make a difference in market share. For example, American Express cards are less popular due to higher merchant fees, limiting their acceptance.More By This Author:

Charted: Visa, Mastercard, And UnionPay Transaction Volumes