Image Source: Investing in the internet is still a spectrum for growth as a seemingly unlimited number of businesses can benefit from what is one of the greatest inventions of our lifetime.There will always be up-and-coming or emerging investments in this regard and after posting strong Q1 results on Thursday, several internet-related stocks are starting to stand out.Dropbox ( – ) – Zacks Rank #2 (BUY)Current Stock Price: $23Serving more than 700 million registered users across 180 countries, Dropbox’s cloud-based platform appears to be in higher demand as a way for businesses and individuals to create, access, and share digital content.Dropbox posted Q1 earnings of $0.58 per share which beat expectations by 18% and climbed 38% from $0.42 a share in the prior-year quarter. First quarter sales slightly edged estimates at $631.3 million and rose 3% from Q1 2023. More impressive, Dropbox has exceeded sales estimates in every quarter since the company went public in 2018 and has now surpassed earnings expectations for eight consecutive quarters.Outlook: Based on Zacks estimates, Dropbox’s annual earnings are expected to be up 1% in fiscal 2024 and are expected to rise another 10% in FY25 to $2.22 per share. Total sales are also expected to increase 1% this year and are forecasted to rise another 3% in FY25 to $2.62 billion.

Image Source: Investing in the internet is still a spectrum for growth as a seemingly unlimited number of businesses can benefit from what is one of the greatest inventions of our lifetime.There will always be up-and-coming or emerging investments in this regard and after posting strong Q1 results on Thursday, several internet-related stocks are starting to stand out.Dropbox ( – ) – Zacks Rank #2 (BUY)Current Stock Price: $23Serving more than 700 million registered users across 180 countries, Dropbox’s cloud-based platform appears to be in higher demand as a way for businesses and individuals to create, access, and share digital content.Dropbox posted Q1 earnings of $0.58 per share which beat expectations by 18% and climbed 38% from $0.42 a share in the prior-year quarter. First quarter sales slightly edged estimates at $631.3 million and rose 3% from Q1 2023. More impressive, Dropbox has exceeded sales estimates in every quarter since the company went public in 2018 and has now surpassed earnings expectations for eight consecutive quarters.Outlook: Based on Zacks estimates, Dropbox’s annual earnings are expected to be up 1% in fiscal 2024 and are expected to rise another 10% in FY25 to $2.22 per share. Total sales are also expected to increase 1% this year and are forecasted to rise another 3% in FY25 to $2.62 billion. Image Source: Zacks Investment ResearchGroupon ( – ) – Zacks Rank #1 (Strong Buy)Current Stock Price: $12With over $16 million global customers, consumers looking to save are certainly familiar with Groupon’s online marketplace which connects them to merchants offering deals on various products and activities.Striving to hold the profitability line, Groupon’s Q1 EPS of $0.06 crushed expectations that called for an adjusted loss of -$0.18 per share and swung from a loss of -$0.65 a share in the comparative quarter. Quarterly sales of $123.08 million came in 4% better than expected and increased from $121.61 million a year ago.Outlook: Groupon is expected to post a profit of $0.05 a share in FY24 compared to an adjusted loss of -$0.52 a share last year. Even better, FY25 EPS is projected to climb to $0.33 with total sales forecasted to rise 6% this year and expected to jump another 7% next year to $585.18 million.

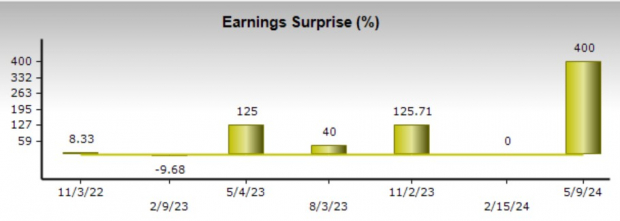

Image Source: Zacks Investment ResearchGroupon ( – ) – Zacks Rank #1 (Strong Buy)Current Stock Price: $12With over $16 million global customers, consumers looking to save are certainly familiar with Groupon’s online marketplace which connects them to merchants offering deals on various products and activities.Striving to hold the profitability line, Groupon’s Q1 EPS of $0.06 crushed expectations that called for an adjusted loss of -$0.18 per share and swung from a loss of -$0.65 a share in the comparative quarter. Quarterly sales of $123.08 million came in 4% better than expected and increased from $121.61 million a year ago.Outlook: Groupon is expected to post a profit of $0.05 a share in FY24 compared to an adjusted loss of -$0.52 a share last year. Even better, FY25 EPS is projected to climb to $0.33 with total sales forecasted to rise 6% this year and expected to jump another 7% next year to $585.18 million. Image Source: Zacks Investment ResearchYelp ( – ) – Zacks Rank #1 (Strong Buy)Current Stock Price: $36With over 500,000 paid advertising accounts, Yelp has remained a popular website that helps businesses connect to consumers and covers restaurants, shopping, and nightlife events to financial and health-related services among others.Yelp’s Q1 EPS of $0.20 crushed estimates of $0.04 a share by 400% and skyrocketed from $0.02 a share in the comparative quarter. Sales of $332.75 million slightly missed estimates of $333.66 million but spiked 7% from $312.44 million in Q1 2023.Outlook: According to Zacks estimates, Yelp’s annual earnings are projected to rise 13% in FY24 and are projected to climb another 34% next year to $2.06 per share. Total sales are forecasted to rise 7% this year and are expected to jump another 7% in FY25 to $1.53 billion.

Image Source: Zacks Investment ResearchYelp ( – ) – Zacks Rank #1 (Strong Buy)Current Stock Price: $36With over 500,000 paid advertising accounts, Yelp has remained a popular website that helps businesses connect to consumers and covers restaurants, shopping, and nightlife events to financial and health-related services among others.Yelp’s Q1 EPS of $0.20 crushed estimates of $0.04 a share by 400% and skyrocketed from $0.02 a share in the comparative quarter. Sales of $332.75 million slightly missed estimates of $333.66 million but spiked 7% from $312.44 million in Q1 2023.Outlook: According to Zacks estimates, Yelp’s annual earnings are projected to rise 13% in FY24 and are projected to climb another 34% next year to $2.06 per share. Total sales are forecasted to rise 7% this year and are expected to jump another 7% in FY25 to $1.53 billion. Image Source: Zacks Investment ResearchTakeawayConsidering these stocks all trade under $40, they are starting to look like affordable options to get in on the ongoing growth of internet-related activities. To that point, their expansion is starting to support their valuations with earnings estimate revisions likely to rise after impressively surpassing Q1 EPS estimates. More By This Author:3 Funds To Buy On Rebounding Semiconductor Sales Bear Of The Day: PENN Entertainment 3 Consumer Food Stocks Receiving Strong Buy Ratings This Week

Image Source: Zacks Investment ResearchTakeawayConsidering these stocks all trade under $40, they are starting to look like affordable options to get in on the ongoing growth of internet-related activities. To that point, their expansion is starting to support their valuations with earnings estimate revisions likely to rise after impressively surpassing Q1 EPS estimates. More By This Author:3 Funds To Buy On Rebounding Semiconductor Sales Bear Of The Day: PENN Entertainment 3 Consumer Food Stocks Receiving Strong Buy Ratings This Week

3 Internet Stocks To Buy For Growth After Beating Q1 Earnings Expectations