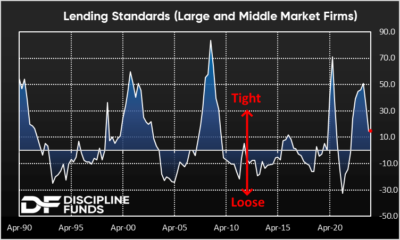

1) Economic Tightness and Easing Demand. Monday’s Senior Loan Survey from the Fed showed continued tight lending conditions. There’s been a lot of debate about whether financial conditions are “tight” enough and I think all you need to look at for this answer is lending standards and actual loan growth. Banks tightening lending standards (shown at right) are still elevated and consistent with an environment where credit is hard to obtain. And total loan growth has slowed to just 2.1% which is much lower than the historical average of 7% and a very low rate of change by any historical standard. This tells us that monetary policy is quite tight and would be consistent with an environment where excess demand (or an inflation boom) isn’t a primary concern.At the same time, the Fed is really threading the needle here. Prices are easing and demand is easing, but neither are crashing in what would be a more worrisome type of disinflation. And speaking of disinflation we got the Manheim Used Vehicle Index reading this morning and it showed a whopping 14% decline in used car prices. This was one of the main drivers of inflation during Covid and the recent readings there are consistent with the type of disinflation we saw in 2023 where prices were a little sticky in January/February and then moved consistently lower the rest of the year. I think the same thing is occurring now even though the rate of change will be slower.

Monday’s Senior Loan Survey from the Fed showed continued tight lending conditions. There’s been a lot of debate about whether financial conditions are “tight” enough and I think all you need to look at for this answer is lending standards and actual loan growth. Banks tightening lending standards (shown at right) are still elevated and consistent with an environment where credit is hard to obtain. And total loan growth has slowed to just 2.1% which is much lower than the historical average of 7% and a very low rate of change by any historical standard. This tells us that monetary policy is quite tight and would be consistent with an environment where excess demand (or an inflation boom) isn’t a primary concern.At the same time, the Fed is really threading the needle here. Prices are easing and demand is easing, but neither are crashing in what would be a more worrisome type of disinflation. And speaking of disinflation we got the Manheim Used Vehicle Index reading this morning and it showed a whopping 14% decline in used car prices. This was one of the main drivers of inflation during Covid and the recent readings there are consistent with the type of disinflation we saw in 2023 where prices were a little sticky in January/February and then moved consistently lower the rest of the year. I think the same thing is occurring now even though the rate of change will be slower.

2) Printing the Money Movie.There’s an MMT movie floating around. Ironically, it costs money to buy it even though the basic gist of the movie is that money grows on trees. The movie is a 90 minute presentation about how the US government has a printing press and can “afford” anything it wants. It depicts mainstream economists as morons and presents Congress as if it believes in a household budget constraint. Did MMTers forget that we spent $25 trillion in the last 4 years, ran $7 trillion deficits and created 10% inflation? Congress does not believe in a household budget constraint even if most laypeople think the government should be run like a household.Anyhow, it takes a lot to make me mad, but I was actually mad after watching this. The movie spreads all the usual MMT type nonsense, but what made me mad was how they presented some mainstream economists who I’ve gotten to know over the years. In fact, I talked to several of these economists in recent days and it’s clear that they were lured into being interviewed under false pretenses and that the clips were edited to make them look even worse. They thought they were doing interviews about the national debt, but in reality they were being interviewed so that MMT advocates could capture gotcha clips and then misconstrue them. The worst part is that they took good economists like Jared Bernstein and Jason Furman, the heads of the Obama and Biden economic councils, and intentionally depicted them as being incompetent. Bernstein is a lifelong advocate for full employment and an exceedingly good man. Yet they presented him as a moron even though he’s part of the political party and economic left-wing thinking that would be most amenable to MMT policy ideas. How reckless can you be? I posted the clip of Bernstein the other day before I knew all of this and I deeply regret having posted it.1Instead of watching the movie I’d recommend reading . Spread it around and help people disabuse themselves of this “new” economic theory. It’s not new and it’s spreading bad faith narratives in the process of demeaning perfectly good economists.2

3) When Money Became Everything.I liked this quote from Jerry Seinfeld about money ():

“In the seventies, this is the tragic turn of American culture. And this was explained to me by Mario Joiner who cracked this puzzle that I could not figure out what the hell happened. That money became everything. What happened because it was not like that in the seventies. In the seventies, it’s how cool is your job? How cool is what you’re doing? If your job’s cooler than my job, you beat me.

He said the eighties was the first time that young guys could make a lot of money fast.

Never existed before. Rich guys were Aristotle Onassis, Andrew Carnegie, shipping, iron. You couldn’t make a lot of money fast in those days.

And it has poisoned our culture to this day. It’s poison.”3

I think about this a lot these days. How much of the mental health crisis we have in the USA is due to our obsession with money? We work too much, we make lots of money, we’re the richest people on the planet and we also seem to have more problems in American society than most other countries. Don’t get me wrong. I am one of the most rah-rah USA people you’ll ever meet. But I do often wonder about our balance in life and whether our society is so geared around earning money that we sacrifice too much else.NB – . We discussed the softening labor market, my broader economic outlook, why I like extending bond durations and how I use gold as a form of portfolio insurance.1 – The thing that really annoyed me about the Bernstein clip was that it was edited to portray him poorly, but also misconstrued the question he was asked. They took a labor economist and asked him to explain the role of bonds in MMT and then lambasted him when he stumbled over the answer. Sure, he didn’t answer it well, but MMTers themselves don’t even know why the bond market exists. They think it’s just a waste based on defunct concepts. But more importantly, why should Bernstein understand a topic like this? He’s a labor economist with a PhD in social work. Of course he doesn’t understand Fed/Tsy operations. It’s like taking a heart surgeon and asking him a complex question about brain surgery and then lambasting all “mainstream doctors”. I thought it was an incredibly unfair depiction of him.2 – Look, there’s nothing wrong with criticizing people. I actually feed off criticism and generally enjoy being criticized. Finance and economics are incredibly difficult things to understand and implement and everyone will be wrong and can benefit from feedback and constantly learning. But we shouldn’t criticize people by misconstruing their views or attacking them under false pretenses. That’s just bad faith criticism.3 – Yes, Seinfeld is fabulously rich so this is maybe weird coming from him. But I don’t think he got into comedy thinking he’d become as successful as he has. He got into comedy because he just enjoys it. Comedy isn’t exactly a get rich quick (or get rich at all) career. The fact that he made a lot of money along the way doesn’t change the fact that our “get rich quick” society has a lot of problems rooted in that mentality.More By This Author:Chart Of The Week: The Softening Labor Market Three Views On The Yen “Collapse” No Or November?