For income-focused investors, real estate investment trusts (REITs) offer the attractive combination of moderate to high yields and the potential for substantial dividend growth. New REITs hit the market through IPO’s or spin-offs and typically come with an exciting story and not much of a track record. With my focus on the safety of dividend payments and visibility of future dividend growth, I like to let new REITs get seasoned in the market before I make an investment decision.

My REIT database includes seven REITs that launched with IPO’s and are now approximately one-year-old as publicly traded companies. Let’s take a quick review of what has happened with each from the IPO until the present time.

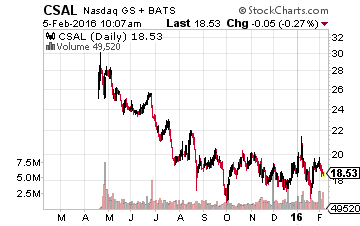

Communications Sales & Leasing Inc. (NASDAQ: CSAL) was spun-off by telecom company Windstream Holdings, Inc. (NASDAQ: WIN) with an April 2015 IPO. With the spin-off, CSAL received Windstream’s 3.5 million mile fiber network and 235,000 miles of copper wire lines. These assets market CSAL as a new type of REIT. At its launch, the REIT had just the single customer, Windstream, with a long-term contract that provided enough cash flow to support an initial $0.60 per share quarterly dividend rate. CSAL management’s stated goal is to acquire additional telecom infrastructure assets to grow revenues and distributable cash flow.

In January 2016, the company announced its first acquisition, a $409 million deal to purchase PEG Bandwidth, a provider of cell site backhaul and dark fiber for telecoms. The CSAL shares had a $30 IPO price and now trade for less than $19. The fairly secure dividend provides a near 13% yield. If CSAL can grow FFO per share and diversify its customer base, this will be a very attractive investment going forward.

TIER REIT Inc. (NYSE: TIER)Â is an office REIT that was a non-public REIT that transitioned to a publicly traded company in July 2015. The company owns about 30 Class A office buildings in 15 cities. Management claims net operating income growth potential of 33% (13% annualized) between the end of 2015 and the end of 2017. With its first two quarters as a public company, cash flow results were one-quarter lower by about 10% and one-quarter higher by a similar percentage compared to results when TIER was a non-public company. This REIT needs to show more stable cash flow growth