The election season is now “officially†kicking off as both parties conduct their nominating conventions. These affairs promise to have more theater than usual given how divided the country is amid the weakest post-war recovery on record, increasing acts of terrorism in the Western world, rising economic inequality, and escalating racial tensions. Given the nature of the two major candidates and their highly unfavorable ratings, it is likely to go down as one of the nastiest presidential elections in memory.

I am making no predictions on this election other than the nation will remain as polarized and divided as it has been in decades, regardless of the winner. If there is one thing 2016 has shown us, it is that trying to predict some event months away is a fool’s game. One just has to look at the recent results of the U.K. referendum that blindsided pundits as well as investors and will lead to the so-called “Brexit,†which is already pushing down European economic growth forecasts.

So which areas of the market might benefit once the election is over? Two sectors of the economy and market come to mind. First, is construction, homebuilding, and infrastructure stocks. Both parties agree that the nation’s infrastructure is crumbling and needs repair. This is one of the few areas of agreement between the two groups.

Mr. Trump has also been defined by building grand projects and one of the first things I think he will target is getting a massive infrastructure package passed as part of his job creation package. Mrs. Clinton will also want this as part of her job creation efforts and also as a payback to the various unions that would benefit from increased infrastructure spending for their support during the election. Both candidates will want the improving housing market to continue, as that is a big source of jobs as well.

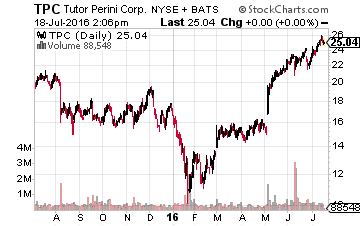

Obviously, this will help home builders as well. One beneficiary will be Tutor Perini (NYSE: TPC), which already is benefiting from increasing spending by local and state governments. The construction giant already has an impressive $8 billion order backlog as it is very involved in mass transit projects as well as big development efforts like the Brooklyn Yards. This is a huge departure from the residential condo skyscrapers that powered its growth prior to the financial crisis. The stock has bounced back very nicely from a poor performance in 2015 and should more than double earnings in FY2016 after a significant drop off in 2015 thanks to some high profile cost overruns.Â