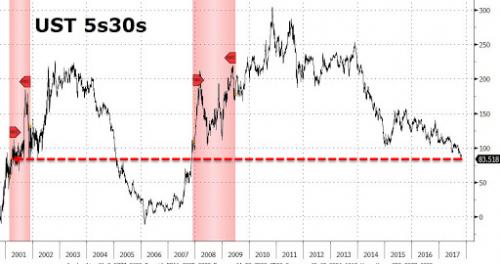

Ignoring the bullish ADP report, the yield curve, and especially the 5s30s has collapsed, bear flattening to 82.8bps, the lowest level since November 2007.

The long end leads the gains across the curve, with 30Y yields richer by 1.7bp on the day, breaching 2.86% for first time since Oct. 20; while 5Y yields are cheaper by 1.5bp.

The catalyst, as reported moments ago, was the refunding announcement by the Treasury, which kept refunding auction sizes fixed contrary to expectations by some that there may be an increase in some auctions, as well as the lack of mention of ultra-long issuance, confirming Mnuchin’s comments from earlier this week. The TBAC minutes also suggested the February 2018 announcement would contain increased issuance in bills, 2-, 3-, and 5-year sectors, shifting new issuance to the short-end and leaving the long-end untouched.

As a reminder, on Monday Treasury Secretary Mnuchin said that the Treasury doesn’t see a lot of demand on ultra-longs and that they will continue to monitor the market for ultra-longs, which was surprising considering the recent Argentina 100 year issuance was 3.5x oversubscribed.

Finally, putting the divergence in context, since the announcement of QE3…