Everyone knows that the Fed, through the bank excess reserves/cash deposit pathway, participated in indirectly purchasing some $1 trillion in risk assets in 2013 through POMO – a process that many have confused with economic recovery. It is also known that corporate stock buybacks have managed to keep S&P 500 EPS rising by removing the total number of shares outstanding (and thus lowering the S in EPS in a world where absolute E stubbornly refuses to grow): after all, someone has to keep those activist shareholders happy or else they release unpleasant letters about corporate CEOs.

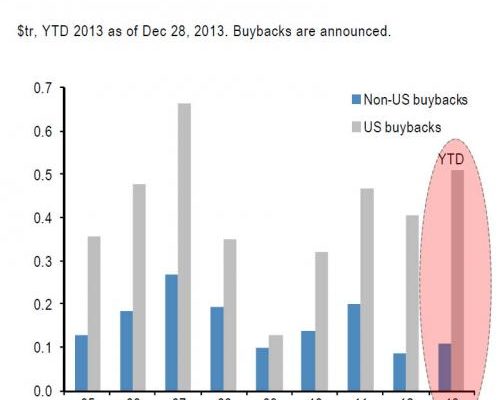

However, what may not be known is just how large the total amount of corporate buybacks in the past year was. The answer: the second highest in history, just shy record of 2007 (when there was no additional $1 trillion in stock purchases coming from the Fed/Primary Dealer complex), amounting to $500 billion (even if non-US buybacks have been a tiny fraction of US).

Presented otherwise, corporations injected roughly half of the total POMO cash used by the Fed to push the S&P straight-line higher.

For the sake of stocks, and with QE tapering, let’s hope that this critical buyer remains in the market or else the tapped out retail investor may have a tough time to keep the S&P at its now more expensive than 2007 level for long.

Â