Image: BigstockThe stock market soared to new highs in 2024, extending an impressive run that began roughly two years ago. The bullish winds appear ready to remain at the market’s sails in 2025 as Wall Street looks to strong earnings growth and lower interest rates, alongside the possibility of lower corporate taxes under the second Trump administration.The current bull market celebrated its second anniversary in October. This is a good sign since bull markets have lasted roughly five and a half years on average, with some running much longer.The stock market could face near-term selling pressure if investors take home profits following the post-Trump election rally and the wider 2024 run. Thankfully, any near-term pullback that occurs would likely create better buying opportunities for investors whenever it comes.The five market-crushing stocks we will explore today have earned Zacks Rank #1 (Strong Buy) ratings, and they appear to be worth buying in 2025 and holding for long-term upside. These stocks are Taiwan Semiconductor Manufacturing, Vistra, Vertiv Holdings, AppLovin Corporation, and MasTec.

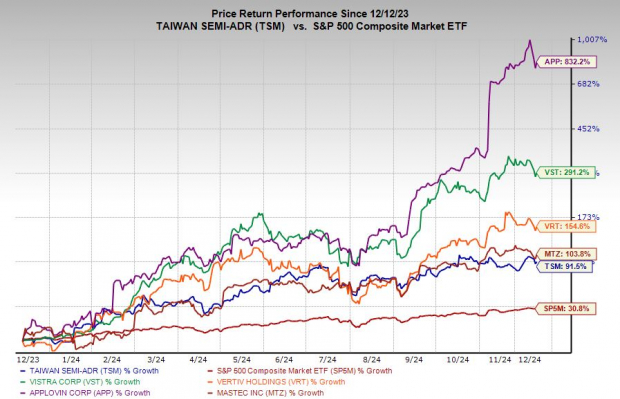

Image: BigstockThe stock market soared to new highs in 2024, extending an impressive run that began roughly two years ago. The bullish winds appear ready to remain at the market’s sails in 2025 as Wall Street looks to strong earnings growth and lower interest rates, alongside the possibility of lower corporate taxes under the second Trump administration.The current bull market celebrated its second anniversary in October. This is a good sign since bull markets have lasted roughly five and a half years on average, with some running much longer.The stock market could face near-term selling pressure if investors take home profits following the post-Trump election rally and the wider 2024 run. Thankfully, any near-term pullback that occurs would likely create better buying opportunities for investors whenever it comes.The five market-crushing stocks we will explore today have earned Zacks Rank #1 (Strong Buy) ratings, and they appear to be worth buying in 2025 and holding for long-term upside. These stocks are Taiwan Semiconductor Manufacturing, Vistra, Vertiv Holdings, AppLovin Corporation, and MasTec. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Taiwan Semiconductor is One of The Best Stocks to Buy for Tech and AI Growth

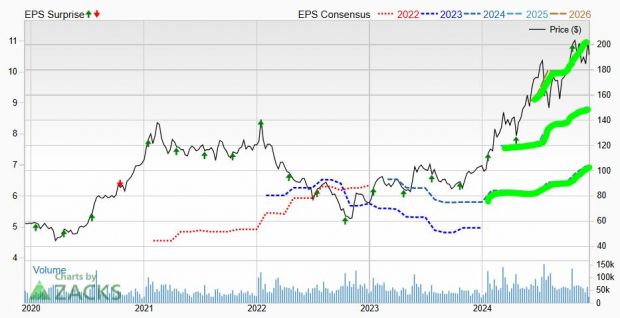

Taiwan Semiconductor Manufacturing Co. ( – ) is arguably the most important company in the world, fueling technological growth across all critical areas of technology, including artificial intelligence. Taiwan Semiconductor physically builds the most cutting-edge chips.The company reportedly holds a roughly 60% share of the entire semiconductor foundry market and 90% of advanced chip manufacturing. Taiwan Semiconductor is boosting its industry-leading 3-nanometer production as its clients like Nvidia ramp up shipments to drive the AI arms race. The costs and institutional knowledge required to build advanced semiconductors have created an impenetrable moat around the company.Taiwan Semiconductor is addressing its geopolitical fears by expanding its manufacturing footprint outside Taiwan into Japan and the US. Image Source: Zacks Investment ResearchThe company’s big beat-and-raise Q3 has helped it earn its Zacks Rank #1 (Strong Buy) rating. The company reported on Dec. 10 that its November sales jumped 34%.Taiwan Semiconductor is projected to boost its adjusted earnings by 35% in 2024 and 27% next year on the back of 29% and 25% respective revenue growth—soaring from $69 billion in 2023 to $112 billion next year. Taiwan Semiconductor shares have more than tripled the Zacks Tech sector over the past 20 years, including a 90% year-to-date charge compared to Tech’s 32%. The stock has been seen trading around 8% below its records and 18% below its average Zacks price target.Despite its run, Taiwan Semiconductor has been trading at a 35% discount to its highs and 20% below the Tech sector at 21.9X forward earnings. On top of that, Taiwan Semiconductor pays a dividend and its balance sheet is solid.

Image Source: Zacks Investment ResearchThe company’s big beat-and-raise Q3 has helped it earn its Zacks Rank #1 (Strong Buy) rating. The company reported on Dec. 10 that its November sales jumped 34%.Taiwan Semiconductor is projected to boost its adjusted earnings by 35% in 2024 and 27% next year on the back of 29% and 25% respective revenue growth—soaring from $69 billion in 2023 to $112 billion next year. Taiwan Semiconductor shares have more than tripled the Zacks Tech sector over the past 20 years, including a 90% year-to-date charge compared to Tech’s 32%. The stock has been seen trading around 8% below its records and 18% below its average Zacks price target.Despite its run, Taiwan Semiconductor has been trading at a 35% discount to its highs and 20% below the Tech sector at 21.9X forward earnings. On top of that, Taiwan Semiconductor pays a dividend and its balance sheet is solid.

Why This Skyrocketing Nuclear and AI Stock Is a Strong Buy

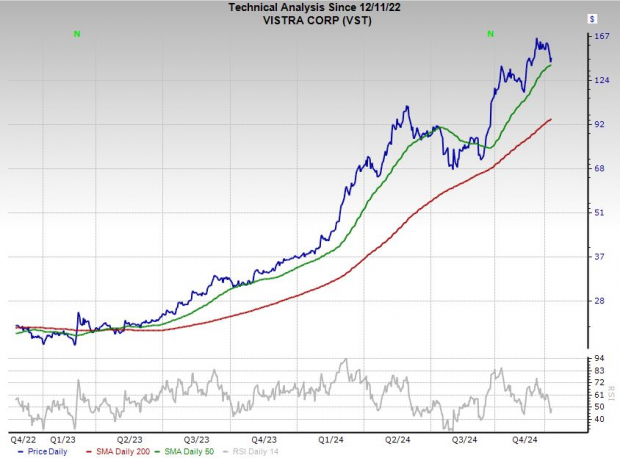

Vistra ( – ) stock has soared over 270% in 2024 for the second-best performance in the S&P 500, crushing Nvidia ( – ). Vistra has shined as investors clamor for its exposure to growth across nuclear energy and infrastructure spending.Vistra is the largest competitive power generator in the US, with a portfolio spanning nuclear, solar, battery storage, natural gas, and beyond. The company owns the second-largest competitive nuclear fleet and the second-largest energy storage capacity in the country.The Texas-based firm serves around 5 million residential, commercial, and industrial retail customers across 20 states. Vistra is projected to grow its revenue by 34% in FY24 and 13% next year to help boost its adjusted earnings by 38% and 26%, respectively. Image Source: Zacks Investment ResearchVistra’s upward earnings revisions have earned it a Zacks Rank #1 (Strong Buy) rating. On top of that, the company also pays a dividend. Vistra’s 2024 run is part of a 610% climb in the last three years, leaving its sector’s 3% move and the S&P 500’s 30% run in the dust. Vistra has been trading 15% below its average Zacks price target, and its Price/Earnings-to-Growth (PEG) Ratio offers 30% value compared to the Zacks Utilities sector. The stock recently found support at its 50-day moving average.

Image Source: Zacks Investment ResearchVistra’s upward earnings revisions have earned it a Zacks Rank #1 (Strong Buy) rating. On top of that, the company also pays a dividend. Vistra’s 2024 run is part of a 610% climb in the last three years, leaving its sector’s 3% move and the S&P 500’s 30% run in the dust. Vistra has been trading 15% below its average Zacks price target, and its Price/Earnings-to-Growth (PEG) Ratio offers 30% value compared to the Zacks Utilities sector. The stock recently found support at its 50-day moving average.

Vertiv Holdings is a Great Picks-and-Shovels AI Investment

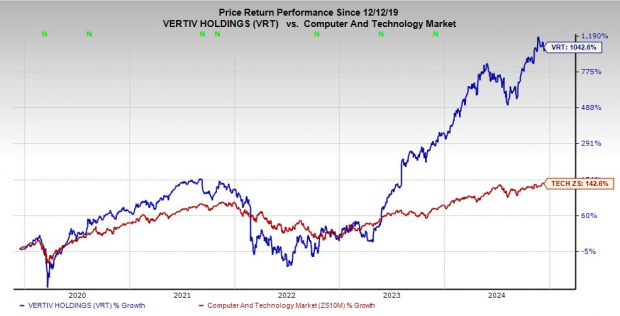

Vertiv Holdings Co ( – ) is a picks-and-shovels investment in the massive expansion of data centers, AI, and other compute-heavy innovations such as cryptocurrencies. Vertiv’s job is to support the smooth, 24/7 operation of data centers, communication networks, and more.Vertiv boosted its guidance last quarter, citing “robust underlying demand” for its critical digital infrastructure products and services across its entire “AI-enabling portfolio of power, thermal, IT systems, infrastructure solutions and services.” Vertiv has been working with Nvidia to help solve future data center efficiency and cooling challenges. Image Source: Zacks Investment ResearchThe company’s improving bottom-line outlook has helped it earn a Zacks Rank #1 (Strong Buy) rating. Vertiv is projected to grow its adjusted EPS by 52% in FY24 and 33% in FY25, following 230% earnings growth last year.The tech stock is projected to boost its sales by 14% and 18%, respectively, to reach $9.2 billion. Wall Street has been paying close attention to and loving Vertiv’s outlook.Vertiv’s stock has ripped 165% higher in 2024 and over 1,000% in the past five years, crushing the Zacks Tech sector during both stretches. Vertiv, like Vistra, recently bounced off its 50-day average and has been seen trading 19% below its average Zacks price target. The stock has also been trading at a 50% discount to Tech in terms of its PEG Price/Earnings-to-Growth (PEG) Ratio.

Image Source: Zacks Investment ResearchThe company’s improving bottom-line outlook has helped it earn a Zacks Rank #1 (Strong Buy) rating. Vertiv is projected to grow its adjusted EPS by 52% in FY24 and 33% in FY25, following 230% earnings growth last year.The tech stock is projected to boost its sales by 14% and 18%, respectively, to reach $9.2 billion. Wall Street has been paying close attention to and loving Vertiv’s outlook.Vertiv’s stock has ripped 165% higher in 2024 and over 1,000% in the past five years, crushing the Zacks Tech sector during both stretches. Vertiv, like Vistra, recently bounced off its 50-day average and has been seen trading 19% below its average Zacks price target. The stock has also been trading at a 50% discount to Tech in terms of its PEG Price/Earnings-to-Growth (PEG) Ratio.

Buy this Skyrocketing Tech Stock for More Growth in 2025?

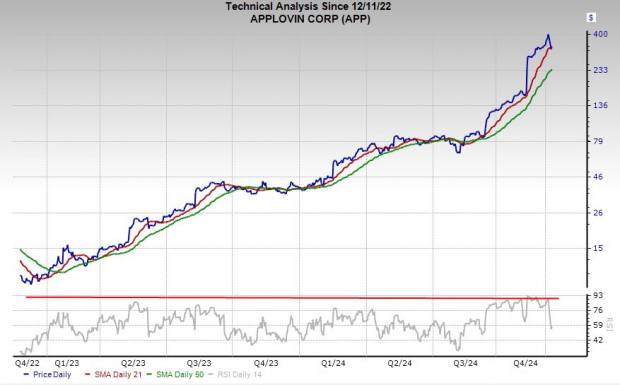

AppLovin Corporation ( – ) was one of the hottest stocks on Wall Street in 2024, charging 745% year-to-date. The run includes a 100% jump since its Q3 earnings release where it supercharged its outlook for 2025 earnings. The digital application monetization company is projected to grow its revenue by 40% in 2024 and 22% next year, taking its revenue to $5.59 billion in 2025 from $1.45 billion in 2020.AppLovin is projected to grow its adjusted earnings by 314% in 2024 and another 45% in 2025, following a huge expansion during the last several years. The company’s upbeat EPS outlook has earned it a Zacks Rank #1 (Strong Buy) rating, and it topped our estimates by an average of 26% in the last four years. Image Source: Zacks Investment ResearchAppLovin’s growth comes as its AI-enhanced portfolio empowers companies and app developers to acquire and keep their ideal users and increase value across customers’ lifecycles.The company helps its clients reach their target users in-app, on mobile devices, and across CTV. AppLovin is thriving as developers and companies flock to its offerings in the hyper-competitive digital app economy.AppLovin’s valuation might force a recalibration of its stock price in the short run. But the stock recently jumped off its 21-day moving average on Wednesday after cooling off from overheated levels.

Image Source: Zacks Investment ResearchAppLovin’s growth comes as its AI-enhanced portfolio empowers companies and app developers to acquire and keep their ideal users and increase value across customers’ lifecycles.The company helps its clients reach their target users in-app, on mobile devices, and across CTV. AppLovin is thriving as developers and companies flock to its offerings in the hyper-competitive digital app economy.AppLovin’s valuation might force a recalibration of its stock price in the short run. But the stock recently jumped off its 21-day moving average on Wednesday after cooling off from overheated levels.

Buy MasTec Stock for Long-Term Infrastructure Spending Growth?

MasTec, Inc. ( – ) more than doubled the Zacks Construction sector over the past 15 years, soaring 1,000%. Despite this run, the stock has lagged slightly behind its sector in the last five years. That recent underperformance could be due to change after it broke out into a new trading range and all-time highs in November, as it was seen soaring 81% year-to-date.MasTec is a top US infrastructure construction firm. The company benefits from electrification, grid improvements and expansion, and other key long-term trends across the energy transition, infrastructure spending, and AI data center growth. MasTec closed last quarter with a record 18-month backlog of $13.9 billion. Image Source: Zacks Investment ResearchMasTec is projected to grow its adjusted earnings by 84% in 2024 and 45% next year. MasTec’s earnings outlook ripped higher after its Q3 release, landing the stock a Zacks Rank #1 (Strong Buy) rating. The company is projected to boost its revenue by 2% in 2024 and 9% next year, following 24% average sales growth in the trailing three years.The company is part of the Building Products – Heavy Construction space that ranks in the top 8% of 250 Zacks industries. MasTec has been trading 14% below its average Zacks price target. Additionally, the stock found buyers at its 50-day moving average on Wednesday.More By This Author:Bear Of The Day: Jack In The Box Inc. Bear Of The Day: The Container Store Group, Inc. Bear Of The Day: Avis Budget Group, Inc.

Image Source: Zacks Investment ResearchMasTec is projected to grow its adjusted earnings by 84% in 2024 and 45% next year. MasTec’s earnings outlook ripped higher after its Q3 release, landing the stock a Zacks Rank #1 (Strong Buy) rating. The company is projected to boost its revenue by 2% in 2024 and 9% next year, following 24% average sales growth in the trailing three years.The company is part of the Building Products – Heavy Construction space that ranks in the top 8% of 250 Zacks industries. MasTec has been trading 14% below its average Zacks price target. Additionally, the stock found buyers at its 50-day moving average on Wednesday.More By This Author:Bear Of The Day: Jack In The Box Inc. Bear Of The Day: The Container Store Group, Inc. Bear Of The Day: Avis Budget Group, Inc.

5 Top Stocks To Buy Now For 2025 Growth