A REIT worth owning should reward investors with regular dividend rate increases. The typical REIT announces a new, higher dividend once a year, followed by four quarterly payouts at the new rate. Across the REIT world, increases happen every month of the year, but January is a popular month for companies to announce a new dividend rate. A dividend bump often results in a share price increase as investors jump in to earn the new higher income rate.

My REIT database includes about 100 REITs with histories of regular dividend increases. With the large number of companies that pick January as the month to announce new dividend rates, today I am going to cover those REITs that should announce an increase in the early days of the new year. You can get a jump on the rest of the REIT investing crowd by picking up shares a few weeks before the news comes out.

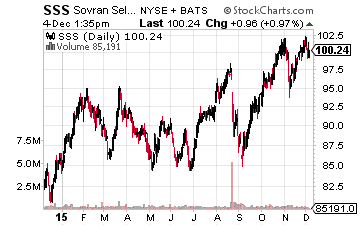

(Click on image to enlarge)

Sovran Self Storage Inc (NYSE: SSS), is a high growth REIT, growing its dividend rate by 89% since 2012. The company has announced a higher dividend in January for each of the last three years. It has also made two mid-year dividend boosts. Adjusted FFO was $1.32 per share for the 2015 third quarter, compared to the current $0.85 quarterly dividend rate. Historically, SSS announces a dividend in the first week of January, with a mid-month record date and payment at the end of January.

(Click on image to enlarge)

DDR Corp (NYSE: DDR)Â develops, acquires, owns and, manages shopping centers. DDR has been a low-teens percentage dividend grower for the last several years. The increase in January this year was 11.3%. The company reported third quarter operating FFO of $0.31 per share, up 7% from a year earlier. The current dividend rate is $0.1725 per share per quarter. Historically DDR announces a new dividend rate during the first week in January with March record and payment dates. The stock currently yields 4.1%.

(Click on image to enlarge)

Cousins Properties Inc (NYSE: CUZ)Â acquires, owns and manages class A office and mixed use properties with a focus area of Georgia, Texas, and North Carolina. Third quarter FFO of $0.24 per share was up 20% from a year earlier, and the 9 months FFO/share was up 15.8%. The 2015 dividend rate is $0.08 per share quarterly. Cousins Properties historically announces a new dividend rate in mid-January with February record and payment dates. This year, the dividend was increased by 6.7%. CUZ currently yields 3.5%.