As we have discussed numerous times, nothing lasts forever – especially reserve currencies– no matter how much one hopes that the status-quo remains so, in the end the exuberant privilege is extorted just one too many times. Headline after headlines shows nations declaring ‘interest’ or direct discussions in diversifying away from the US dollar… and as SCMP reports, Standard Chartered notes that at least 40 central banks have invested in the Yuan and several more are preparing to do so. The trend is occurring across both emerging markets and developed nation central banks diversifiying into ‘other currencies’ and “a great number of central banks are in the process of adding yuan to their portfolios.” Perhaps most ominously, for king dollar, is the former-IMF manager’s warning that “The Yuan may become a de facto reserve currency before it is fully convertible.”

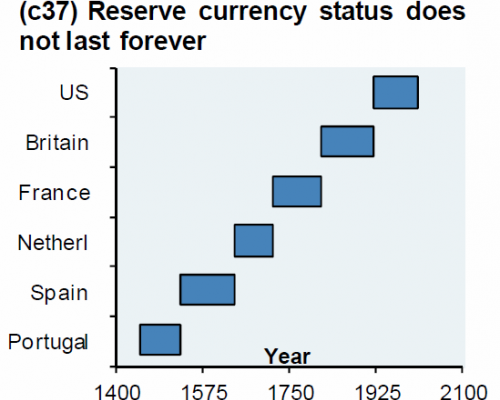

The infamous chart that shows nothing lasts forever…

Nothing lasts forever… (especially in light of China’s recent comments)

As The South China Morning Post reports, Jukka Pihlman, Standard Chartered’s Singapore-based global head of central banks and sovereign wealth funds (who formerly worked at the International Monetary Fund advising central banks on asset-management issues), notes that:

At least 40 central banks have invested in the yuan and several others are preparing to do so, putting the mainland currency on the path to reserve status even before full convertibility

The US dollar remains in charge (for now)…but

The US dollar is still the world’s most widely held reserve currency, accounting for nearly 33 per cent of global foreign exchange holdings at the end of last year, according to IMF data. That ratio has been declining since 2000, when 55 per cent of the world’s reserves were denominated in US dollars.

The IMF does not disclose the percentage of reserves held in yuan, but theemerging market countries’ share of reserves in “other currencies” has increased by almost 400 per cent since 2003, while that of developed nations grew 200 per cent, according to IMF data.