While banks are gearing up for the Q2 earnings season, the Federal Reserve has given clean bills of health to majority of the large American banks. Strong jobs numbers, in fact, raised the possibility of further rate hikes which bodes well for banks.

The financial sector at large posted its biggest one-day advance in over three months, with banks leading the way. Let us, thus, focus on banks that are likely to make the most of the Q2 earnings season. Such banks are positioned to report upbeat earnings results, which will eventually lead to an uptick in share price.

Dividend Boost

So far this year, bank stocks have been underperforming the broader S&P 500. But bullish investors are optimistic that banks’ discouraging performance will soon come to an end. Banks are planning to bump up dividends after passing the Fed’s latest round of stress tests with flying colors. This, invariably, will provide a boost to share prices of a select number of U.S. banks. The increasing number of dividends is a reflection of tax cut benefits and stronger capital ratios. In fact, greater capital ratios give banks more room to boost shareholder returns.

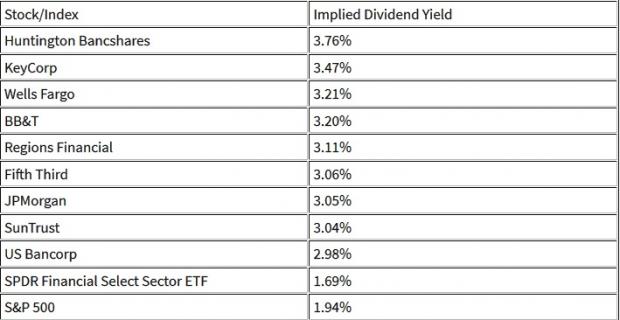

Nine banks, namely Huntington Bancshares, KeyCorp, Wells Fargo & Company (WFCÂ -Â Free Report), BB&T, Regions Financial, Fifth Third Bancorp, JPMorgan Chase & Co. (JPMÂ -Â Free Report), SunTrust Banks and US Bancorp, have already planned to increase dividends.

(Click on image to enlarge)

(Source:Â MarketWatch, Data as of July 2)

Banks Are Undervalued

Banks’ poor show this year, by the way, may indicate that they are comparatively undervalued compared to the broader equity market. While the KBW Nasdaq Bank Index has shed 0.1% on a year-to-date basis, the S&P is up 4%.

Bespoke Investment Group macro strategist George Pearkes has in fact found out by using a mathematical model that bank stock prices by utilizing two-year Treasury yields and investment-grade bond spreads as model inputs, are recently priced at 9% below their fair values. Thus, banks have the potential to climb higher.