Image: BigstockWe’ve all become accustomed to the artificial intelligence (AI) theme, with many investors clamoring for exposure. And the results we’ve received from several companies have helped confirm the positivity surrounding the theme, further exciting investors.Thankfully, there are several angles investors can use to obtain exposure, such as Nvidia ( – ) for the hardware side, Vertiv ( – ) for data center services, and Palantir ( – ) for the software angle. Let’s take a closer look at each.

Image: BigstockWe’ve all become accustomed to the artificial intelligence (AI) theme, with many investors clamoring for exposure. And the results we’ve received from several companies have helped confirm the positivity surrounding the theme, further exciting investors.Thankfully, there are several angles investors can use to obtain exposure, such as Nvidia ( – ) for the hardware side, Vertiv ( – ) for data center services, and Palantir ( – ) for the software angle. Let’s take a closer look at each.

Nvidia Remains the Clear AI Favorite

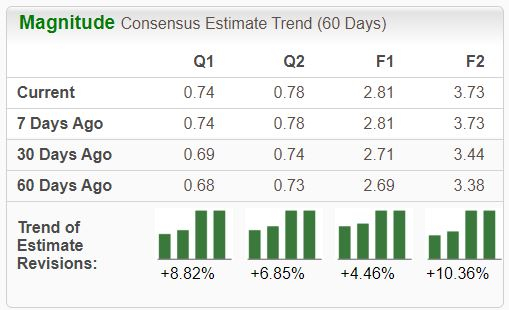

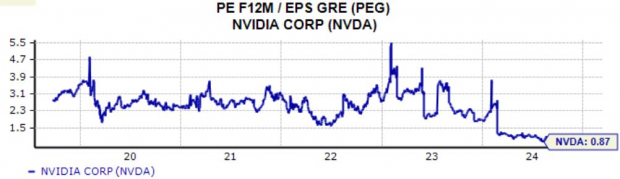

Nvidia shares have finally taken a breather over the last three months, as they have been essentially flat compared to the S&P 500’s 4% gain. Shares didn’t see a melt-up following its latest release like they had previously, though results were once again remarkable.The company maintains a notably bright outlook across the board, undoubtedly constructive for share performance moving forward despite the recent sideways action. Remember that Nvidia is one of the ‘late’ reporters during earnings season, with its next release scheduled for Nov. 19. Image Source: Zacks Investment ResearchConcerning its latest quarterly release, the AI favorite generated record quarterly sales of $30 billion, reflecting an impressive 122% year-over-year climb. As usual, Data Center results reflected the main event, with a quarterly sales record of $26.3 billion up 150% on a year-over-year stack.And despite its strong run, the valuation picture here remains attractive, with the recent 36.2X forward 12-month earnings multiple comparing favorably to the 50.7X five-year median. The PEG works out to 0.8X, reflective of both growth and value.

Image Source: Zacks Investment ResearchConcerning its latest quarterly release, the AI favorite generated record quarterly sales of $30 billion, reflecting an impressive 122% year-over-year climb. As usual, Data Center results reflected the main event, with a quarterly sales record of $26.3 billion up 150% on a year-over-year stack.And despite its strong run, the valuation picture here remains attractive, with the recent 36.2X forward 12-month earnings multiple comparing favorably to the 50.7X five-year median. The PEG works out to 0.8X, reflective of both growth and value. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Vertiv Keeps Data Centers Cool

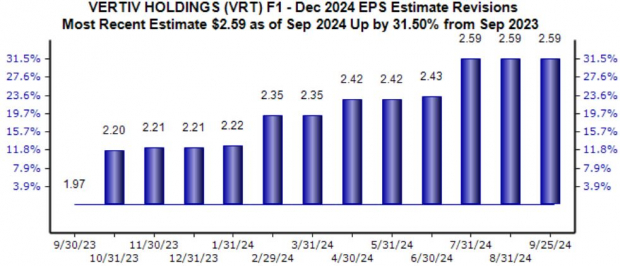

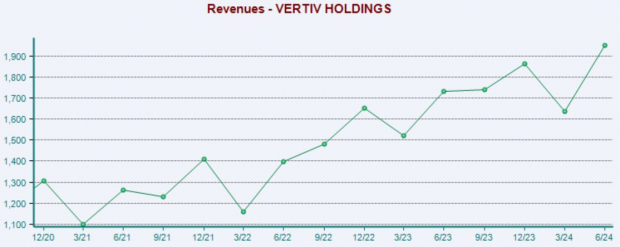

Vertiv provides services for data centers, communication networks, and commercial and industrial facilities with a portfolio of power, cooling, and IT infrastructure solutions and services. The outlook for its current fiscal year continues to be rosy, with the $2.59 Zacks Consensus EPS estimate up 32% over the last year, suggesting 45% year-over-year growth. Image Source: Zacks Investment ResearchThe company’s latest set of results came in strong, with Vertiv enjoying 57% year-over-year growth in organic orders alongside a 13% sales increase. Due to the momentum it’s recently been enjoying, Vertiv upped its current year sales, operating profit, and adjusted free cash flow outlook following the print.Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment ResearchThe company’s latest set of results came in strong, with Vertiv enjoying 57% year-over-year growth in organic orders alongside a 13% sales increase. Due to the momentum it’s recently been enjoying, Vertiv upped its current year sales, operating profit, and adjusted free cash flow outlook following the print.Below is a chart illustrating the company’s sales on a quarterly basis. Image Source: Zacks Investment ResearchThe company has continued to see an increasing scaling of AI deployment, boasting the capacity needed to capture the massive opportunity.

Image Source: Zacks Investment ResearchThe company has continued to see an increasing scaling of AI deployment, boasting the capacity needed to capture the massive opportunity.

Palantir Sees Customer Momentum

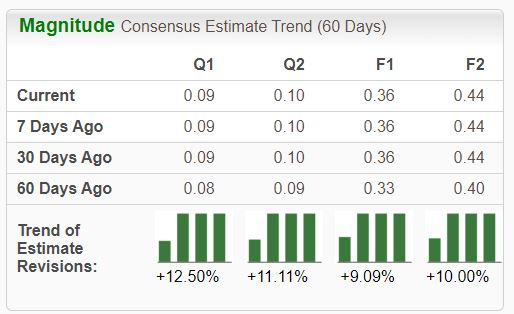

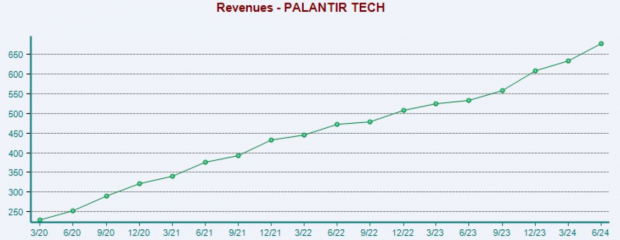

Palantir builds software that empowers organizations to effectively integrate their data, decisions, and operations. The stock has maintained a bullish outlook across the board, with analysts revising their earnings expectations well higher over recent months. Image Source: Zacks Investment ResearchIts latest quarterly release brought post-earnings positivity, exceeding both earnings and revenue expectations while also lifting its current-year sales outlook. Revenue soared 27% year-over-year, whereas adjusted EPS climbed 200%.The company’s platform continues to be highly attractive, reflected by 41% year-over-year customer growth. Impressively, Palantir closed over 27 deals worth $10 million throughout the period, further reflecting snowballing demand.”Our growth across the commercial and government markets has been driven by an unrelenting wave of demand from customers for artificial intelligence systems that go beyond the merely performative and academic,” said Alexander Carp, CEO, in a letter to shareholders.The company’s top line has remained notably strong, as shown below.

Image Source: Zacks Investment ResearchIts latest quarterly release brought post-earnings positivity, exceeding both earnings and revenue expectations while also lifting its current-year sales outlook. Revenue soared 27% year-over-year, whereas adjusted EPS climbed 200%.The company’s platform continues to be highly attractive, reflected by 41% year-over-year customer growth. Impressively, Palantir closed over 27 deals worth $10 million throughout the period, further reflecting snowballing demand.”Our growth across the commercial and government markets has been driven by an unrelenting wave of demand from customers for artificial intelligence systems that go beyond the merely performative and academic,” said Alexander Carp, CEO, in a letter to shareholders.The company’s top line has remained notably strong, as shown below. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

The artificial intelligence (AI) theme continues to grip investors, causing many to seek exposure.To reiterate, investors can play the trade through several angles, including Nvidia ( – ) for the hardware side, Vertiv ( – ) for data center services, and Palantir ( – ) for the software angle. More By This Author:3 Key Upcoming Quarterly Releases Investors Can’t Ignore: NKE, PGR, DPZThese 3 Stocks Are Decade-Long Outperformers: Cintas, Domino’s Pizza, Caterpillar3 Top Large Cap Stocks For A Stable Approach: ETN, DECK, UNH

3 Unique Investment Angles For Artificial Intelligence: Nvidia, Vertiv, Palantir