Image: BigstockGrowth investing has made a big comeback this year among investors, with many high-flying names enjoying positive price action throughout the period. Still, it’s critical to note that growth investing is commonly volatile by nature, perhaps steering away those with a more conservative approach.The style is centered around targeting companies expected to grow their earnings and revenues at an above-average level, a development that commonly follows through to share outperformance.For those interested in the growth investing style, these three stocks – Celestica ( – ), Booking Holdings ( – ), and Arista Networks ( – ) – could all be strong considerations.On top of strong projected growth, all three sport a favorable Zacks Rank. Here is a closer look at each.

Image: BigstockGrowth investing has made a big comeback this year among investors, with many high-flying names enjoying positive price action throughout the period. Still, it’s critical to note that growth investing is commonly volatile by nature, perhaps steering away those with a more conservative approach.The style is centered around targeting companies expected to grow their earnings and revenues at an above-average level, a development that commonly follows through to share outperformance.For those interested in the growth investing style, these three stocks – Celestica ( – ), Booking Holdings ( – ), and Arista Networks ( – ) – could all be strong considerations.On top of strong projected growth, all three sport a favorable Zacks Rank. Here is a closer look at each.

Arista Networks

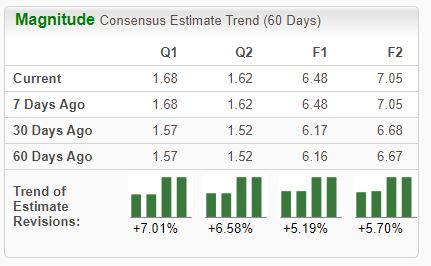

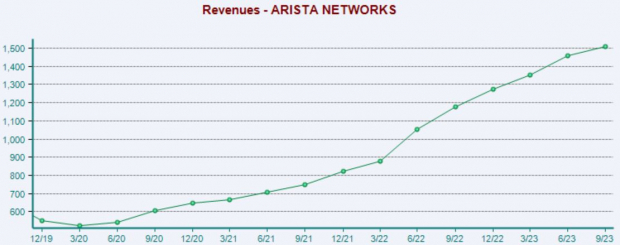

Arista Networks shares have benefited nicely from the AI frenzy in 2023, up more than 70% year-to-date and widely outperforming relative to the S&P 500. The company provides network switches to hyperscalers that speed up communication between computer servers.The stock is a Zacks Rank #2 (Buy), with expectations moving higher across all timeframes. Image Source: Zacks Investment ResearchIn its latest print, ANET posted a 15% EPS surprise and reported revenue 2% ahead of expectations, with both items improving notably from the same period last year. As shown below, ANET’s revenue growth has been remarkable over the recent years, picking up considerable steam from the post-pandemic lows.

Image Source: Zacks Investment ResearchIn its latest print, ANET posted a 15% EPS surprise and reported revenue 2% ahead of expectations, with both items improving notably from the same period last year. As shown below, ANET’s revenue growth has been remarkable over the recent years, picking up considerable steam from the post-pandemic lows. Image Source: Zacks Investment ResearchInvestors will have to fork up a premium for ANET shares, with the recent 32.6X forward earnings multiple residing on the higher end. Still, investors have had little issue forking up the premium given ANET’s forecasted growth, with earnings forecasted to climb 35% in its current year, paired with a 33% revenue boost.

Image Source: Zacks Investment ResearchInvestors will have to fork up a premium for ANET shares, with the recent 32.6X forward earnings multiple residing on the higher end. Still, investors have had little issue forking up the premium given ANET’s forecasted growth, with earnings forecasted to climb 35% in its current year, paired with a 33% revenue boost.

Celestica

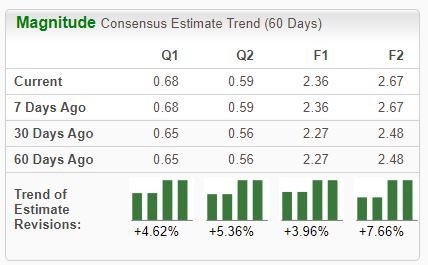

Celestica is one of the world’s largest electronics manufacturing services companies, serving the computer and communications sectors. Analysts have taken their earnings expectations higher across the board, landing the stock into a Zacks Rank #1 (Strong Buy). Image Source: Zacks Investment ResearchThe company boasts an inspiring growth profile, with earnings forecasted to climb 24% in its current year (FY23) on 9% higher revenues. And looking ahead to FY24, estimates allude to a 13% boost in earnings paired with a 6.5% sales increase.In addition, it’s worth noting that shares aren’t overly expensive given the company’s forecasted growth, with the recent 0.4X forward price-to-sales ratio (F1) sitting on the lower end of the spectrum.

Image Source: Zacks Investment ResearchThe company boasts an inspiring growth profile, with earnings forecasted to climb 24% in its current year (FY23) on 9% higher revenues. And looking ahead to FY24, estimates allude to a 13% boost in earnings paired with a 6.5% sales increase.In addition, it’s worth noting that shares aren’t overly expensive given the company’s forecasted growth, with the recent 0.4X forward price-to-sales ratio (F1) sitting on the lower end of the spectrum. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Booking Holdings

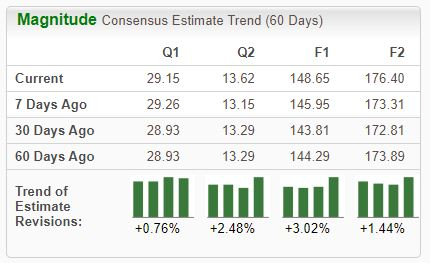

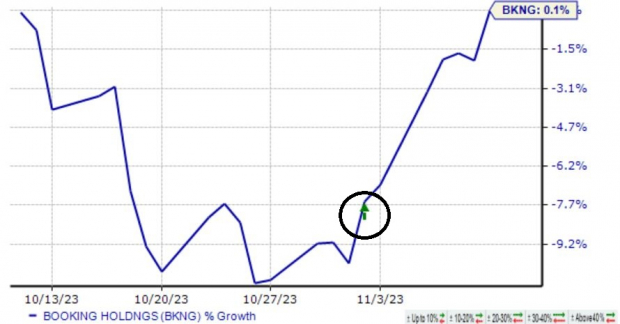

Booking Holdings, a current Zacks Rank #2 (Buy), is one of the largest online travel companies in the world. The company has enjoyed positive earnings estimate revisions across the board following better-than-expected quarterly results. Image Source: Zacks Investment ResearchRegarding the mentioned release, BKNG posted a 6.5% surprise relative to the Zacks Consensus EPS Estimate and reported revenue 1.5% ahead of expectations, with both items improving nicely from the year-ago period. Shares got a considerable boost post-earnings, as illustrated below.

Image Source: Zacks Investment ResearchRegarding the mentioned release, BKNG posted a 6.5% surprise relative to the Zacks Consensus EPS Estimate and reported revenue 1.5% ahead of expectations, with both items improving nicely from the year-ago period. Shares got a considerable boost post-earnings, as illustrated below. Image Source: Zacks Investment ResearchAnd the company’s growth profile is notably robust for its current fiscal year, with consensus expectations alluding to a 50% earnings boost paired with a 24% revenue climb.

Image Source: Zacks Investment ResearchAnd the company’s growth profile is notably robust for its current fiscal year, with consensus expectations alluding to a 50% earnings boost paired with a 24% revenue climb.

Bottom Line

Growth investors faced a challenging environment in 2022, with many macroeconomic forces dampening the mood.However, all three stocks above – Celestica ( – ), Booking Holdings ( – ), and Arista Networks ( – ) – have jumped back into favor in 2023, with analysts positively revising their earnings expectations.All three are forecasted to witness solid earnings and revenue growth in the current and coming year, making them solid considerations for those with a growth-focused mindset.More By This Author:3 Key Quarterly Releases To Watch Next Week – Friday, November 103 Funds To Boost Your Portfolio On Soaring Semiconductor Sales3 Top-Ranked Stocks Breaking 52-Week Highs

3 Top-Ranked Stocks Suited For Growth Investors