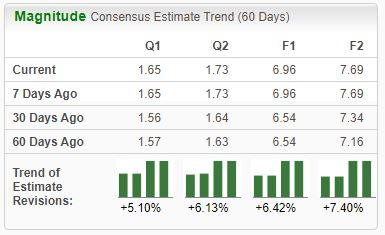

Image Source: Zacks Investment ResearchKeep an eye out for the company’s upcoming release expected on November 16th, as the Zacks Consensus EPS Estimate of $1.65 has been taken 12% higher since just mid-August. The company is forecasted to post $3.8 billion in revenue, 11% higher than the year-ago period.

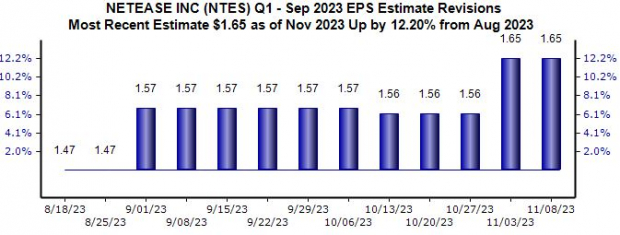

Image Source: Zacks Investment ResearchKeep an eye out for the company’s upcoming release expected on November 16th, as the Zacks Consensus EPS Estimate of $1.65 has been taken 12% higher since just mid-August. The company is forecasted to post $3.8 billion in revenue, 11% higher than the year-ago period. Image Source: Zacks Investment ResearchNTES shares also pay a dividend, currently yielding 1.9% annually. And the company has shown a commitment to increasingly rewarding shareholders, boasting a 27% five-year annualized dividend growth rate.Please note that the chart below is on an annual basis.

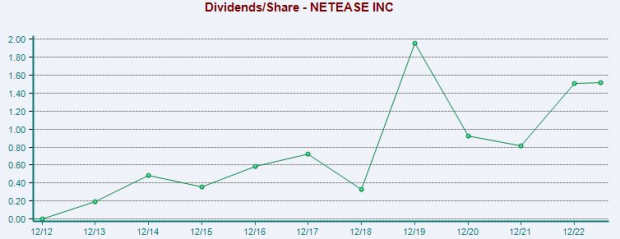

Image Source: Zacks Investment ResearchNTES shares also pay a dividend, currently yielding 1.9% annually. And the company has shown a commitment to increasingly rewarding shareholders, boasting a 27% five-year annualized dividend growth rate.Please note that the chart below is on an annual basis. Image Source: Zacks Investment ResearchPinterestPinterest provides a platform to show its users visual recommendations based on their personal tastes and interests, generating revenues by delivering ads on its website and mobile application. The company’s shares have found momentum following its latest quarterly release, as we can see illustrated below.

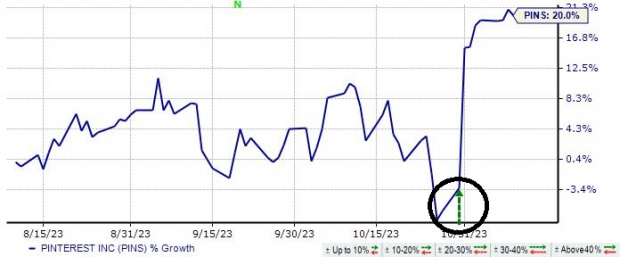

Image Source: Zacks Investment ResearchPinterestPinterest provides a platform to show its users visual recommendations based on their personal tastes and interests, generating revenues by delivering ads on its website and mobile application. The company’s shares have found momentum following its latest quarterly release, as we can see illustrated below. Image Source: Zacks Investment ResearchRegarding the recent release, the company posted a 33% EPS beat and reported sales 3% ahead of expectations. In addition, monthly active users totaled 482 million, improving 8% year-over-year and reflecting continued platform expansion.The company’s top line has primarily remained steady, showing consistent improvement.

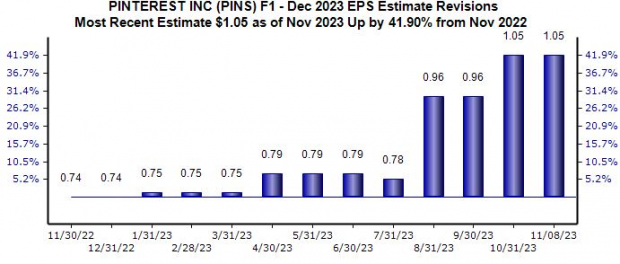

Image Source: Zacks Investment ResearchRegarding the recent release, the company posted a 33% EPS beat and reported sales 3% ahead of expectations. In addition, monthly active users totaled 482 million, improving 8% year-over-year and reflecting continued platform expansion.The company’s top line has primarily remained steady, showing consistent improvement. Image Source: Zacks Investment ResearchAnalysts have taken their current year expectations notably higher, with the current $1.05 Zacks Consensus EPS Estimate being revised 40% higher over the last year. The stock is currently a Zacks Rank #1 (Strong Buy).

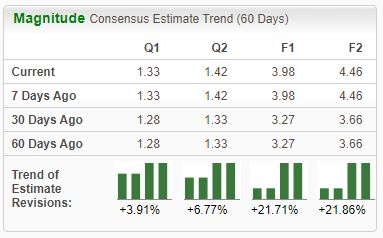

Image Source: Zacks Investment ResearchAnalysts have taken their current year expectations notably higher, with the current $1.05 Zacks Consensus EPS Estimate being revised 40% higher over the last year. The stock is currently a Zacks Rank #1 (Strong Buy). Image Source: Zacks Investment ResearchStride Inc.Stride, a current Zacks Rank #1 (Strong Buy), is a premier provider of K-12 education for students, schools, and districts, including career learning services through middle and high school curricula. Analysts have lifted their earnings expectations across the board.

Image Source: Zacks Investment ResearchStride Inc.Stride, a current Zacks Rank #1 (Strong Buy), is a premier provider of K-12 education for students, schools, and districts, including career learning services through middle and high school curricula. Analysts have lifted their earnings expectations across the board. Image Source: Zacks Investment ResearchThe company posted a notably strong print in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 120% and posting revenue 5% ahead of expectations. Shares have consistently been boosted post-earnings in 2023, as we can see below.

Image Source: Zacks Investment ResearchThe company posted a notably strong print in its latest release, exceeding the Zacks Consensus EPS Estimate by more than 120% and posting revenue 5% ahead of expectations. Shares have consistently been boosted post-earnings in 2023, as we can see below. Image Source: Zacks Investment ResearchStride also carries solid growth expectations, with estimates alluding to 34% earnings growth in its current year on 9% higher sales. Shares currently trade at a 14.3X forward earnings multiple (F1), beneath the 17.9X five-year median and five-year highs of 64.1X.

Image Source: Zacks Investment ResearchStride also carries solid growth expectations, with estimates alluding to 34% earnings growth in its current year on 9% higher sales. Shares currently trade at a 14.3X forward earnings multiple (F1), beneath the 17.9X five-year median and five-year highs of 64.1X. Image Source: Zacks Investment ResearchBottom LineStocks nearing or breaking 52-week highs reflect considerable momentum, with positive earnings estimates from analysts commonly providing the fuel needed to continue climbing.And for those interested in stocks seeing notable buying pressure, all three above – NetEase, Pinterest, and Stride Inc. – precisely fit the criteria.In addition to favorable price action, all three have seen their near-term earnings outlooks shift positively.More By This Author:Will Continued Inflation Hurt Home Depot’s Q3 Earnings?Compared To Estimates, Biogen Inc. Q3 Earnings: A Look At Key MetricsGilead Sciences Tops Q3 Earnings And Revenue Estimates

Image Source: Zacks Investment ResearchBottom LineStocks nearing or breaking 52-week highs reflect considerable momentum, with positive earnings estimates from analysts commonly providing the fuel needed to continue climbing.And for those interested in stocks seeing notable buying pressure, all three above – NetEase, Pinterest, and Stride Inc. – precisely fit the criteria.In addition to favorable price action, all three have seen their near-term earnings outlooks shift positively.More By This Author:Will Continued Inflation Hurt Home Depot’s Q3 Earnings?Compared To Estimates, Biogen Inc. Q3 Earnings: A Look At Key MetricsGilead Sciences Tops Q3 Earnings And Revenue Estimates

3 Top-Ranked Stocks Breaking 52-Week Highs