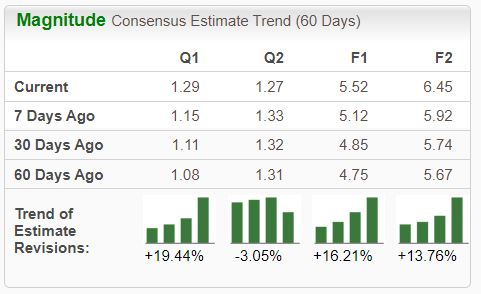

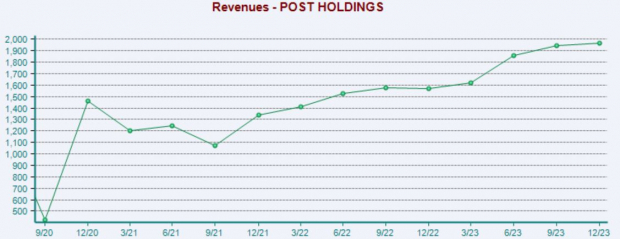

Investors closely monitor insider buys. But who are ‘insiders’?An insider is defined by Section 16 of the Security Exchange Act as an officer, director, 10% stockholder, or anyone who possesses information because of their relationship with the company.Of course, many strict rules apply to insiders. Notably, they have a longer holding period than most, a critical aspect that investors should be aware of.Three companies – Post Holdings () , Casey’s General Stores () , and Aon () – have all seen recent insider activity. For those interested in trading like the insiders, let’s take a closer look at each. Post HoldingsPost Holdings is a consumer-packaged goods holding company involved in the production of center-of-the-store, refrigerated, foodservice, food ingredient and convenient nutrition product categories and the private brand food category.The stock is currently a Zacks Rank #1 (Strong Buy), with earnings expectations moving higher across nearly all timeframes. A director recently scooped up 1000 POST shares, with the total transaction totaling roughly $105k.(Click on image to enlarge) Image Source: Zacks Investment ResearchA notably strong earnings release has fueled shares higher, with POST recently delivering a 60% beat relative to the Zacks Consensus EPS estimate and exceeding sales expectations by 2%. Both items were well higher than year-ago figures, with a more favorable operating environment providing tailwinds.The company’s revenue has recovered nicely post-pandemic, as shown below.(Click on image to enlarge)

Image Source: Zacks Investment ResearchA notably strong earnings release has fueled shares higher, with POST recently delivering a 60% beat relative to the Zacks Consensus EPS estimate and exceeding sales expectations by 2%. Both items were well higher than year-ago figures, with a more favorable operating environment providing tailwinds.The company’s revenue has recovered nicely post-pandemic, as shown below.(Click on image to enlarge) Image Source: Zacks Investment Research Casey’s General StoresCasey’s General Stores operates convenience stores under the Casey’s and Casey’s General Store names in many midwestern states. A director purchased 725 CASY shares near the beginning of 2024, with the transaction totaling nearly $200k.The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations moving higher across the board.(Click on image to enlarge)

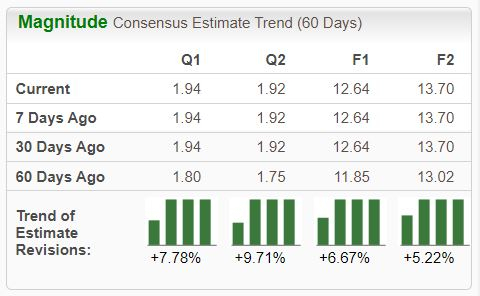

Image Source: Zacks Investment Research Casey’s General StoresCasey’s General Stores operates convenience stores under the Casey’s and Casey’s General Store names in many midwestern states. A director purchased 725 CASY shares near the beginning of 2024, with the transaction totaling nearly $200k.The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations moving higher across the board.(Click on image to enlarge) Image Source: Zacks Investment ResearchShares trade a slight discount relative to historical levels, with the current 22.7X forward earnings multiple (F1) sitting beneath five-year highs of 32.2X and in line with the respective Zacks Retail – Convenience Stores average.The stock sports a Style Score of ‘B’ for Value.(Click on image to enlarge)

Image Source: Zacks Investment ResearchShares trade a slight discount relative to historical levels, with the current 22.7X forward earnings multiple (F1) sitting beneath five-year highs of 32.2X and in line with the respective Zacks Retail – Convenience Stores average.The stock sports a Style Score of ‘B’ for Value.(Click on image to enlarge) Image Source: Zacks Investment Research AonAon is a multinational corporation offering risk management services, insurance and reinsurance brokerage, human resource consulting, and outsourcing services worldwide. A director recently made a big splash, acquiring 50k shares at a total transaction value of roughly $7.5 million.The company’s shareholder-friendly nature shouldn’t be overlooked, boasting a 9.2% five-year annualized dividend growth rate. Shares currently yield 0.8% on an annual basis paired with a sustainable payout ratio sitting at 17% of its earnings.(Click on image to enlarge)

Image Source: Zacks Investment Research AonAon is a multinational corporation offering risk management services, insurance and reinsurance brokerage, human resource consulting, and outsourcing services worldwide. A director recently made a big splash, acquiring 50k shares at a total transaction value of roughly $7.5 million.The company’s shareholder-friendly nature shouldn’t be overlooked, boasting a 9.2% five-year annualized dividend growth rate. Shares currently yield 0.8% on an annual basis paired with a sustainable payout ratio sitting at 17% of its earnings.(Click on image to enlarge) Image Source: Zacks Investment ResearchAon is expected to enjoy solid growth, with consensus estimates for its current fiscal year suggesting 12.7% earnings growth on nearly 8% higher sales. Growth continues in FY25, as expectations allude to an additional 8% bump in earnings paired with a 15% sales increase. Bottom LineMany investors closely monitor insider buys, as they can provide a high level of confidence. After all, if an insider didn’t believe in the company’s future pathway, why would they buy?And all three stocks above – Post Holdings, Casey’s General Stores, and Aon – have seen recent insider activity.More By This Author:

Image Source: Zacks Investment ResearchAon is expected to enjoy solid growth, with consensus estimates for its current fiscal year suggesting 12.7% earnings growth on nearly 8% higher sales. Growth continues in FY25, as expectations allude to an additional 8% bump in earnings paired with a 15% sales increase. Bottom LineMany investors closely monitor insider buys, as they can provide a high level of confidence. After all, if an insider didn’t believe in the company’s future pathway, why would they buy?And all three stocks above – Post Holdings, Casey’s General Stores, and Aon – have seen recent insider activity.More By This Author:

3 Stocks Seeing Insider Activity