Hooray! The “Trump trade†is back. Not really.

I mean, it is. I guess. Assuming you thought it was justified/real in the first place and assuming you ignore the fact that, as SocGen’s Kit Juckes wrote earlier today, “the moves over the last three weeks while big, can easily be dismissed as a reaction to the excessive gloom of late August when the fed wasn’t going to hike again in 2017, Donald Trump’s war of words with Kim Jong-Un was beginning to make daily headlines, hurricane season was just beginning to affect economic sentiment and hopes of any fiscal easing had died.â€

In other words, there’s certainly some hint of the “Trump bump†creeping back into the market, but this “bump†is more of a “bounce†from lows that were themselves the product of everyone fading nearly every “Trump trade†on the board as it became increasingly apparent that the absurd expectations which served to make long USD and short USTs “sure bets†headed into 2017 failed to take into account the inherent uncertainty that surrounds making a reality TV show host the leader of the free world.

Then again, if that’s the case and nothing goes wrong-er-er from here, then it’s conceivable that there’s some gas left in the tank.

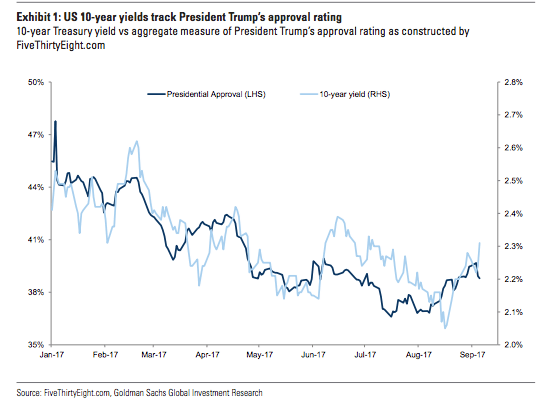

One way to look at things (and this is perhaps the simplest way to capture all facets of this debate) is simply to plot 10Y yields against Trump’s approval rating. Here’s a chart from Goldman:

So the question here is simple: is this sustainable?

Goldman thinks it might be. Or at least in the near-term.

And they’ve got three reasons why they believe that. Here they are, submitted for your consideration: