Image Source: Investors closely monitor insider buys.It’s easy to understand why; if an insider buys, it can deliver a positive message to shareholders, indicating that they’re confident in the long-term picture of the business.But who are insiders?An insider is defined by Section 16 of the Security Exchange Act as an officer, director, 10% stockholder, or anyone who possesses information because of their relationship with the company.Many strict rules apply to insiders.Insiders can’t trade based on material nonpublic information, they must pre-clear all trades, and all transactions of the company’s stock must occur during the Window Period.In addition, insiders have a longer holding period than most, a critical aspect that investors should be aware of.Three companies – Walgreens Boots Alliance (), FedEx (), and Casey’s General Stores () – have all seen recent insider activity. For those interested in insider activity, let’s take a closer look at each.Casey’s General StoresCasey’s General Stores operates convenience stores under the Casey’s and Casey’s General Store names in many midwestern states. A director recently purchased 725 CASY shares, with the transaction totaling nearly $200k.The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations moving higher across the board.

Image Source: Investors closely monitor insider buys.It’s easy to understand why; if an insider buys, it can deliver a positive message to shareholders, indicating that they’re confident in the long-term picture of the business.But who are insiders?An insider is defined by Section 16 of the Security Exchange Act as an officer, director, 10% stockholder, or anyone who possesses information because of their relationship with the company.Many strict rules apply to insiders.Insiders can’t trade based on material nonpublic information, they must pre-clear all trades, and all transactions of the company’s stock must occur during the Window Period.In addition, insiders have a longer holding period than most, a critical aspect that investors should be aware of.Three companies – Walgreens Boots Alliance (), FedEx (), and Casey’s General Stores () – have all seen recent insider activity. For those interested in insider activity, let’s take a closer look at each.Casey’s General StoresCasey’s General Stores operates convenience stores under the Casey’s and Casey’s General Store names in many midwestern states. A director recently purchased 725 CASY shares, with the transaction totaling nearly $200k.The stock is a Zacks Rank #1 (Strong Buy), with earnings expectations moving higher across the board. Image Source: Zacks Investment ResearchInvestors stand to reap a steady income from CASY shares, currently yielding 0.6% annually. While it’s not a steep yield, the company’s 7% five-year annualized dividend growth rate reflects its commitment to increasingly rewarding shareholders.Walgreen Boots AllianceWalgreens Boots Alliance operates as a retail drugstore chain. The company sells prescription and non-prescription drugs, as well as general merchandise products, including household items, convenience and fresh foods, personal care, beauty care, photofinishing, and candy.The CEO recently made a big splash, acquiring 10,000 shares at a total transaction value of just under $250k. Still, it’s worth noting that analysts have taken their current year expectations well lower since last October, with the current $3.29 Zacks Consensus EPS Estimate down 32% during the period.

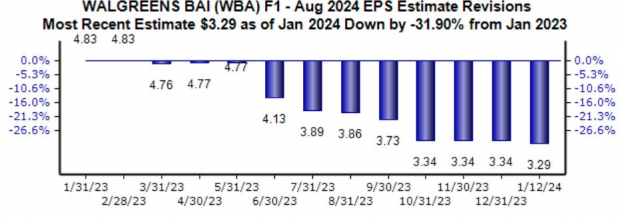

Image Source: Zacks Investment ResearchInvestors stand to reap a steady income from CASY shares, currently yielding 0.6% annually. While it’s not a steep yield, the company’s 7% five-year annualized dividend growth rate reflects its commitment to increasingly rewarding shareholders.Walgreen Boots AllianceWalgreens Boots Alliance operates as a retail drugstore chain. The company sells prescription and non-prescription drugs, as well as general merchandise products, including household items, convenience and fresh foods, personal care, beauty care, photofinishing, and candy.The CEO recently made a big splash, acquiring 10,000 shares at a total transaction value of just under $250k. Still, it’s worth noting that analysts have taken their current year expectations well lower since last October, with the current $3.29 Zacks Consensus EPS Estimate down 32% during the period. Image Source: Zacks Investment ResearchFedExFedEx provides an extensive portfolio of transportation, e-commerce, and business services through companies competing collectively, operating independently, and managed collaboratively under the FedEx brand.A director recently purchased 200 shares, with the total transaction totaling $50k. FedEx’s earnings outlook has suffered a fate similar to that of WBA, with expectations moving lower across all timeframes.

Image Source: Zacks Investment ResearchFedExFedEx provides an extensive portfolio of transportation, e-commerce, and business services through companies competing collectively, operating independently, and managed collaboratively under the FedEx brand.A director recently purchased 200 shares, with the total transaction totaling $50k. FedEx’s earnings outlook has suffered a fate similar to that of WBA, with expectations moving lower across all timeframes. Image Source: Zacks Investment ResearchBottom LineMany investors closely monitor insider buys, as they can provide a high level of confidence. After all, if an insider didn’t believe in the company’s future pathway, why would they buy?And all three stocks above – Walgreens Boots Alliance, FedEx, and Casey’s General Stores – have seen recent insider activity.More By This Author:3 Key Stocks To Watch This Earnings Season Bull of the Day: AZZ3 Top-Ranked Large-Caps To Buy For Growth

Image Source: Zacks Investment ResearchBottom LineMany investors closely monitor insider buys, as they can provide a high level of confidence. After all, if an insider didn’t believe in the company’s future pathway, why would they buy?And all three stocks above – Walgreens Boots Alliance, FedEx, and Casey’s General Stores – have seen recent insider activity.More By This Author:3 Key Stocks To Watch This Earnings Season Bull of the Day: AZZ3 Top-Ranked Large-Caps To Buy For Growth

3 Large-Cap Stocks Seeing Insider Activity