One of my associates at Investors Alley recently made this observation:

“All over Atlanta right now there are massive multi-family projects going up everywhere and it’s the same for other cities like Atlanta that are seeing lots of young professionals moving into the city and rent instead of buying a house. Could be a long-term trend going on here of increased urbanization and people renting vs. buying.â€

It’s great to get an investment idea that derives from actual on the ground observation. I had not recently spent a lot of time looking at the apartment owning REIT companies, so this was a good push to dig in. My first impression is that there are some very large multi-family REITs, and this is a significant REIT subsector. My research came up with 13 apartment-focused REITs. Four would be classified as large cap, with market values from $10 billion up to $29 billion. The next group includes five midcap REITs with market values ranging from $1.6 billion up to $6.7 billion. Finally, I found four small cap multi-family REITs with market values of $230 million to $350 million.

A review of yields and dividend growth rates in the sector shows a surprising level of uniformity. All of the large and midcap REITs carry yields between 3% and 4%, with the majority showing high single digit year-over-year growth rates. When you drop down to the small cap companies, two out of four carry 9.5% to 10% yields, with no histories of dividend growth. The two small cap companies with growth potential yield 6% to 7%. As I noted at the start of the article, the on-the-ground report from my millennial aged associate focuses on finding the growth and total return potential out of the bunch. After a review of recent results, here are several multi-family REITs that stand out from the pack.

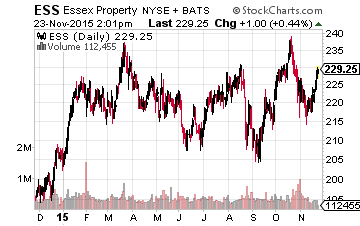

(Click on image to enlarge)

Out of the large cap group,Essex Property Trust Inc (NYSE: ESS) has grown its market value by 50% over the last two years, from $10 billion to over $15 billion. The ESS dividend is growing at a 10% annual rate. The company’s properties are located in Southern California, the San Francisco Bay area and Seattle. ESS currently yields 2.7%.