Dividend longevity is a highly desirable trait for income investors, and for good reason. Companies that have proven to stand the test of time, including competitive headwinds, recessions, and other threats to earnings, typically afford investors the ability to accrue significant wealth over time. Most companies cannot meet these strict requirements for dividend longevity, so for those that do, it is worth taking notice.Perhaps the best-known group of exemplary dividend stocks is the , a group of just 66 companies that have raised their dividends for at least 25 consecutive years. The group contains stocks from just about all sectors, but utilities – a long-time favorite of income investors – boasts three stocks on the list of Dividend Aristocrats. In this article, we’ll look at those three stocks and what makes them attractive for today.

3 Dividend Aristocrat Utilities

NextEra Energy, Inc. (NEE)NextEra Energy (NEE) is an electric utility with two operating segments, Florida Power & Light (“FPL”) and NextEra Energy Resources (“NEER”). FPL is the largest U.S. electric utility by retail megawatt hour sales and customer numbers. The rate-regulated electric utility serves about 5.9 million customer accounts in Florida. NEER is the largest generator of wind and solar energy in the world. NEE was founded in 1925. NEE generates roughly 80% of its revenues from FPL. NextEra Energy reported its Q3 2024 financial results on 10/23/24. For the quarter, the company reported revenues of $7.6 billion (up 5.5% year over year), translating to adjusted earnings of $2.1 billion (up 11% year over year). Adjusted earnings climbed 10% to $1.03 on a per share basis. The utility added ~3 GW of new renewables and storage projects to its backlog, including ~1.4 GW of solar and ~1.4 GW of battery storage, bringing its backlog to over 24 GW. Year to date, it generated operating revenue of $19.4 billion down 8.8% year over year, adjusted earnings of $6.0 billion (up 11%), and adjusted earnings per share (“EPS”) of $2.90 (up 9%). Management maintained its 2024 adjusted EPS guidance range at $3.23 to $3.43.NextEra’s growth has been quite impressive for a utility, averaging about 9% annually in the past decade. That is partially because NextEra sees a small amount of organic growth each year through rate increases, increased usage, and higher customer counts. However, the company acquires growth as well from time to time, adding to its top and bottom-line growth potential. We estimate NextEra can grow earnings by 7% annually in the foreseeable future.NextEra’s competitive advantage is like many other utilities in that it has what amounts to a monopoly in its service areas. Combined with NextEra’s massive scale, it is a very efficient operator.The company’s dividend increase streak is currently at 29 years, and its is just 63% of earnings. That means that not only is the payout very safe, considering the company’s relatively predictable earnings, but it also has ample room to grow over time.(Click on image to enlarge) Source: Portfolio Insight

Source: Portfolio Insight

Consolidated Edison, Inc. (ED)

Our next stock is Consolidated Edison or ConEd. This utility operates regulated electric, gas, and steam delivery businesses in and around New York City. The company offers electric services to 3.5 million customers, gas to 1.1 million, and steam to a minimal number of customers. ConEd also has a small renewable energy generation and infrastructure business. The utility is our second stick on the list of Dividend Aristocrats.ConEd was founded in 1823 and generates over $13 billion in annual revenue. On January 18th, 2024, Consolidated Edison announced that it was 2.5% to $0.83. This is the company’s 50th annual increase, qualifying Consolidated Edison as a . ConEd is also one of the few companies with .On November 7th, 2024, Consolidated Edison reported third-quarter results for the period ending September 30th, 2024. Revenue improved 5.7% for the quarter to $4.1 billion, which topped estimates by $26 million. Adjusted earnings of $583 million, or $1.68 per share, compared to adjusted earnings of $561 million, or $1.62 per share, in the previous year. Adjusted earnings-per-share were $0.10 more than anticipated. As with prior periods, higher rate bases for gas and electric customers were the primary contributors to results in the CECONY business, which accounts for the vast majority of the company’s assets. Once again, the denial of approval to capitalize costs related to implementing the new customer billing and information systems was a headwind to results. Average are still expected to grow by 6.4% annually from 2024 to 2028, up from 6% previously.Consolidated Edison initiated its most extensive investment program in its history last year. It has completed its installation of smart meters in its network. This will help customers optimize energy use while the company will be able to realize lower peak demand and thus reduce its operating cost. The company also expects capital investment of ~$4.8 billion for 2024 and ~$23 billion for 2025 through 2028. Consolidated Edison has grown its earnings-per-share at a 3.8% average annual rate during the last decade. The company has grown its at a 2.8% annual rate.ConEd’s competitive advantage is undoubtedly the area it serves. Like other utilities, ConEd has a monopoly in its service area, but it operates in the New York City metropolitan area, home to millions of people and countless businesses. Source: Portfolio Insight

Source: Portfolio Insight

Atmos Energy Corporation (ATO)

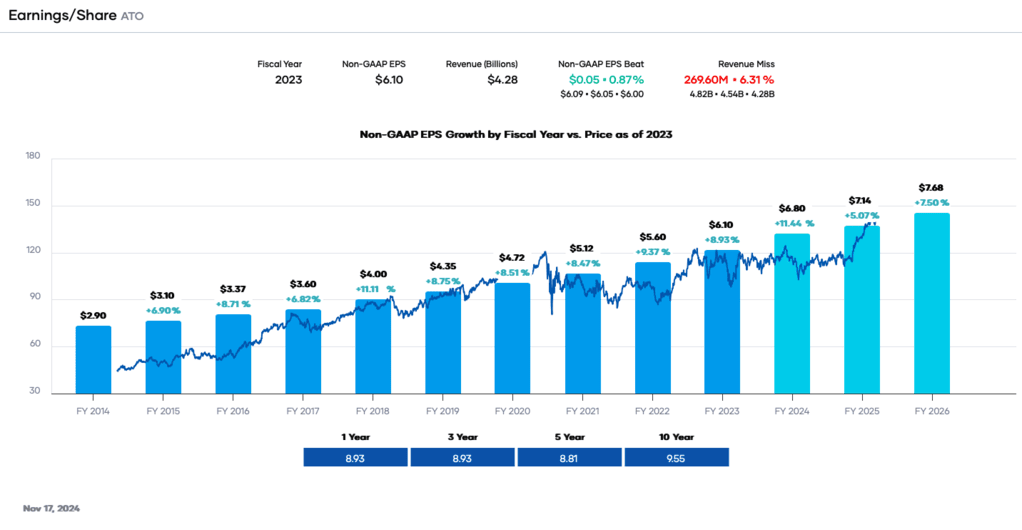

Our final stock is Atmos Energy, a natural gas utility based in Texas. Atmos, unlike the other two on this list, is heavily leveraged to one type of fuel: natural gas. Atmos operates in eight states in the US, distributing gas to three million customers. It also owns a pipeline and storage business. The equity is our third Dividend Aristocrat utility.Atmos has done an exemplary job of growing earnings in the past decade, averaging 10% annually over that time frame. It has been able to do that via a combination of organic growth in customer counts, rate increases, and well-targeted acquisitions. We expect an average of 6% annual earnings growth in the coming years from the same factors.On November 6th, the company reported fiscal fourth-quarter financial results. For the full year, earnings-per-share came to $6.83, while net income came to $1 billion. Earnings-per-share beat the average analyst estimate by $0.03. Atmos also increased its quarterly dividend by 8%. Fiscal 2025 earnings per diluted share is expected to be in the range of $7.05 to $7.25 per diluted share.The company’s competitive advantage is similar to other utilities in its monopoly, but we also like Atmos’ geographic diversification. Rather than being in a concentrated area, Atmos operates in a wide swath of the southern United States.Atmos has raised its dividend for 41 consecutive years, with the probability of decades of further increases.(Click on image to enlarge) Source: Portfolio InsightMore By This Author:

Source: Portfolio InsightMore By This Author:

3 Dividend Aristocrat Utilities To Power Your Portfolio