When stocks are cruising at or nearing all-time highs, it reflects considerable bullishness with trends where buyers are in control. Stocks making new highs tend to make even higher highs, particularly when analysts’ positive earnings estimate revisions are rolling in. That’s been precisely the case for Duolingo ( – ), SharkNinja ( – ), and DaVita ( – ), all of which presently sport a favorable Zacks Rank and are trading near 52-week highs. Let’s take a closer look at what’s been driving the bullish behavior.

SharkNinja Enjoys Robust Growth

SharkNinja, a current Zacks Rank #1 (Strong Buy), is a diversified product design and technology company that creates lifestyle solutions through products for consumers. The company’s outlook has shifted bullishly across the board following its latest set of rock-solid quarterly results. Image Source: Zacks Investment ResearchConcerning the above-mentioned quarterly print, SN posted 34% EPS Growth on 31% higher sales, with revenue of $1.2 billion penciling in the fifth consecutive period of double-digit percentage Y/Y sales growth.And the growth is expected to continue nicely, with consensus expectations for its current fiscal year alluding to 31% EPS growth on 21% higher sales. Peeking a bit ahead, expectations for FY25 suggest an additional 14% pop in EPS paired with a 9% sales increase.The stock sports a Style Score of ‘B’ for Growth. Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment ResearchConcerning the above-mentioned quarterly print, SN posted 34% EPS Growth on 31% higher sales, with revenue of $1.2 billion penciling in the fifth consecutive period of double-digit percentage Y/Y sales growth.And the growth is expected to continue nicely, with consensus expectations for its current fiscal year alluding to 31% EPS growth on 21% higher sales. Peeking a bit ahead, expectations for FY25 suggest an additional 14% pop in EPS paired with a 9% sales increase.The stock sports a Style Score of ‘B’ for Growth. Below is a chart illustrating the company’s sales on a quarterly basis.

Image Source: Zacks Investment ResearchUp 110% in 2024, shares have been red hot, with its earnings outlook supportive of further gains.

DVA’s Valuation Remains Attractive

DaVita is a leading provider of dialysis services in the U.S. to patients suffering from chronic kidney failure, also known as end-stage renal disease (ESRD). The stock is currently a Zacks Rank #1 (Strong Buy), with expectations moving higher across all timeframes. Image Source: Zacks Investment ResearchThe valuation picture here for DVA is decently enticing, with the current forward 12-month earnings multiple of 14.0X primarily in line with historical levels. In addition, the current PEG ratio works out to 0.8X, reflecting a bargain relative to the growth expected.Typically, a PEG ratio beneath 1.0 indicates both growth and value. The stock sports a Style Score of ‘A’ for Value.

Image Source: Zacks Investment ResearchThe valuation picture here for DVA is decently enticing, with the current forward 12-month earnings multiple of 14.0X primarily in line with historical levels. In addition, the current PEG ratio works out to 0.8X, reflecting a bargain relative to the growth expected.Typically, a PEG ratio beneath 1.0 indicates both growth and value. The stock sports a Style Score of ‘A’ for Value.

Image Source: Zacks Investment Research

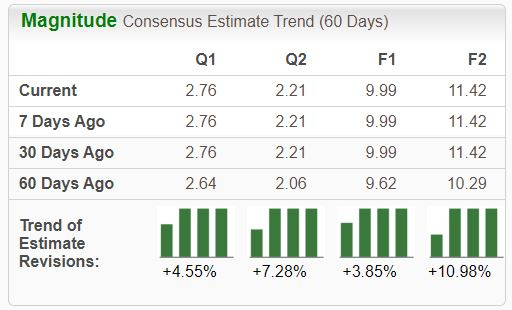

Duolingo Sees Huge Growth Forecast

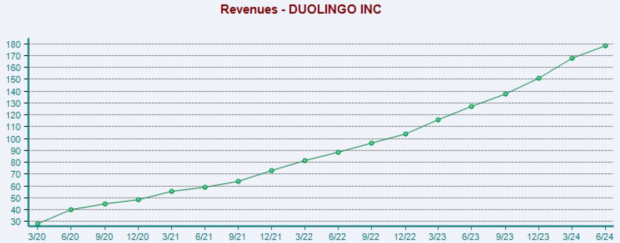

Duolingo, a Zacks Rank #1 (Strong Buy), provides a mobile language learning platform. The company’s forecasted growth is robust, with consensus expectations for its current fiscal year alluding to 430% EPS growth paired with a 40% sales bump.The company’s growth has already been historically strong, posting double-digit percentage year-over-year sales growth rates in each of its last ten quarters. Below is a chart illustrating DUOL’s sales on a quarterly basis.

Image Source: Zacks Investment ResearchShares trade at elevated valuation multiples, with the current 109.3X forward 12-month earnings multiple reflective of investors’ big growth expectations. And the company is forecasted to deliver just that, as mentioned above.

Bottom Line

Stocks making new highs tend to make even higher highs, particularly when positive earnings estimate revisions hit the tape.That’s precisely what all three stocks above – Duolingo, SharkNinja, and DaVita – have enjoyed, with each sporting a favorable Zacks Rank and seeing their shares trade near 52-week highs.More By This Author:Insider Trading: 3 Recent Large-Cap Purchases3 Unique Investment Angles For Artificial Intelligence: Nvidia, Vertiv, Palantir3 Key Upcoming Quarterly Releases Investors Can’t Ignore: NKE, PGR, DPZ

3 Buy Rated Stocks Cruising At 52 Week Highs