<< Read More: 2007 All Over Again? Let Us Count The Ways (And Remember What Happened Then) – Part 1

<< Read More:Â 2007 All Over Again? Mega-Merger Edition – Part 2

So far, each financial crisis in the series that began with the junk bond bubble of 1989 has been noticeably different from its predecessors. New instruments, new malefactors, new monetary policy experiments in response.

But the one that’s now emerging feels strikingly similar to what just happened a few years ago: Banks overexposed to assets they thought were safe but turn out to be highly risky see their balance sheets deteriorate, their liquidity dry up and their stocks plunge.

This time it’s starting in Europe, where bank stocks are down by over 20% year-to-date and credit spreads are exploding. For a general look at this process see Is Another European Bank Crisis Starting?

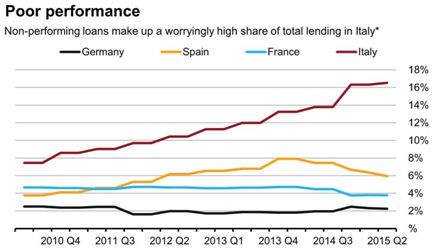

Not surprisingly, the scariest stories are emanating from Italy which, despite inventing the mega-bank concept during the reign of the Medici, seems unable to grasp how money actually works. Check out the following Wall Street Journal chart of non-performing loans. When 16% of an entire country’s borrowers have stopped making their payments, that country is pretty much over.

All eyes are therefore on Italy’s Banca Monte dei Paschi, which has a non-performing loan ratio of 33% and, as a result, a plunging share price. When the Italian economy finally blows up, this will probably be where it starts.

But here the story takes an even more disturbing turn. It seems that the other lender now spooking the markets is none other than Deutsche Bank, pillar of the world’s best-performing economy. Shockingly-bad recent numbers have combined with questions about its mountain of derivatives and exotic debt to put DB in a very uncomfortable spotlight. Excerpts from analysis of the aforementioned debt: